For the final 2-3 yrs, an increasing number of traders need to diversify past Indian equities and need to spend money on different nations shares.

All of us have seen information of how some worldwide shares like Amazon, Fb, and Tesla and so on are doing fantastic and in the present day we’ll see how Indian traders may also spend money on these worldwide shares in 3 methods

#1 – Straight by way of a Dealer web site

One of many methods to spend money on international equities is thru a brokerage home by opening a Demat/buying and selling account.

This may both be an Indian brokerage home like ICICIDirect, Motilal Oswal which has tie-up with a overseas brokerage home once more. Or it will also be some new-age startups like Vested, IndMoney which has a direct tie-up with the worldwide brokerage homes.

As soon as your account is opened, you may switch the cash to that account and do the purchase and promote transactions. Nonetheless word that these are fairly costly in nature, just because there are switch charges (whereas sending and whereas taking again the cash in your account) which might make them fairly costly particularly in case your ticket measurement is kind of small.

Right here is an easy illustration given on this tweet on solely Rs 6,166 get invested if you put Rs 10,000 as a result of some huge cash will get eaten up within the costs and so on.

Tempted to spend money on US Shares straight?

Maintain your horses✋

In the event you can’t make investments a minimum of ₹1 Lakh at a time, you’re doomed to make important losses the second you switch???? into your US dealer a/c.

Big remittance costs (per transaction) is the satan nobody talks about ???? pic.twitter.com/OJX39TvXTK

— Babu (@pooniawalla) March 23, 2021

This merely signifies that this route is just for somebody whose transactions is of huge measurement, and somebody who desires the enjoyable of choosing the shares themselves and evaluations them on their very own. I really feel it is a cumbersome technique of investing out of India, merely because of the paperwork and hassles concerned.

#2 – Investing by way of a mutual fund

One other strategy to spend money on worldwide shares is thru a mutual fund. The very best a part of that is that for a retail investor, there isn’t a change in course of and no additional paperwork. You possibly can merely purchase the models of mutual funds or do the SIP in the identical method.

One other nice benefit is that you simply get tons of selection and choices you get by way of a mutual fund. If you wish to make investments straight in shares by way of a dealer, largely you will note the choice for investing in US-based corporations solely.

Nonetheless, with mutual funds, you may get choices primarily based on nations, rising markets, sectors or geographies.. Listed here are some examples

By Nations / Area

These are mutual funds that focus totally on a selected nation or a area.

- Edelweiss Better China Fairness Off-shore Fund

- DSP US Versatile Fairness

- Edelweiss US Worth Fairness Offshore Fund

- Edelweiss Europe Dynamic Fairness Offshore Fund

- Edelweiss Asean Fairness Off Shore Fund

- HSBC Brazil Fund Gr Dir

World or Rising Markets Funds (which invested in varied nations)

These are funds that primarily are usually not linked to any nation, however are able to spend money on varied nations shares relying on progress sectors and alternatives noticed.

- Kotak World Rising Mkt

- ABSL World Rising Opp

- PGIM India World Fairness Opp

- Sundaram World Model Fund

- Edelweiss Rising Mkts Opp Fairness Offshore Fund

- Mirae Asset NYSE FANG + ETF FOF

- Kotak NASDAQ 100 FOF

- Motilal Oswal S&P 500 Index Fund

Funds primarily based on a theme/sector

Lastly, there are funds which can be targeted on a selected sector or theme and really feel that it’s too promising. It may be know-how, Actual property or consumption and so on.

- Edelweiss US Expertise Fairness FOF

- Axis World Innovation FOF

- Invesco India Invesco World Client Traits FOF

- DSP World Gold Fund

- Kotak Intl REIT FOF

- DSP World Vitality

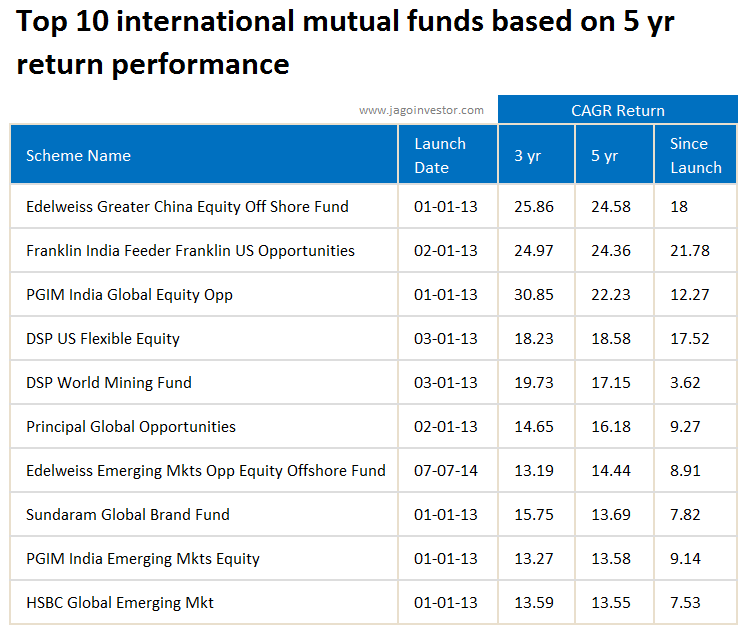

I might to additionally present you the highest 10 worldwide mutual funds primarily based on 5 yrs returns.

Know this, earlier than you spend money on worldwide mutual funds

Word that it’s additionally fairly fancy to suppose that you’re investing in a global portfolio, so many individuals go overboard and put a really excessive quantity in these funds. Have a look at these funds primarily as a strategy to diversify your portfolio and cut back the dependence on Indian equities solely. There isn’t any compulsion that you need to make investments out of India.

Additionally, on the taxation entrance, one huge drawback of those worldwide mutual funds is that they’re taxed like a debt fund. Sure- so any earnings you earn earlier than 3 yrs, they are going to be handled as a brief time period capital acquire and taxed at your earnings slab charges.

Remaining level is that these are all largely funds of funds on the finish of the day, which signifies that they’re only a mutual fund that’s shopping for the mutual fund models of one other overseas mutual fund (that’s completely okay). So their expense ratio could also be a little bit on the upper facet!. But when they’re saying you from all hassles, paperwork and guesswork, I feel it’s price paying the charges and take part within the fund.

Do let me know if in case you have any questions on investing in international equities?