Do you precisely perceive what the Declare Settlement Ratio in Insurance coverage is?

Lots of people simply take a look at the declare settlement ratio and make an opinion about an insurance coverage firm. On this article, let me break some myths and enable you to perceive extra concerning the declare settlement ratio.

What’s Declare Settlement Ratio?

In easy phrases, the declare settlement ratio is the share of claims paid in a monetary yr.

Declare Settlement Ratio = (No of Declare Paid / No of Claims Acquired)

So if an organization will get 1000 claims in a yr and pays 985 of them, then its declare settlement ratio for that yr can be 98.5%. An necessary level to notice right here is that it’s concerning the variety of claims and never the variety of claims.

What kind of Claims is taken into account within the Declare Settlement Ratio?

Usually, the general public prepared to purchase a time period plan search for this ratio as they’re involved concerning the declare getting paid in case of their early demise. However declare settlement ratio shouldn’t be the identical because the “demise declare settlement ratio”

Within the calculation of the declare settlement ratio (within the case of life insurers), all forms of claims are thought of like.

- Dying Declare: The claims as soon as the policyholder dies

- Maturity Claims: Insurance policies which can be maturing and must be settled

- Give up Claims: Insurance policies which can be closed prematurely and surrendered

Right here is the breakup from the IRDA report of 2019-2020, the place you possibly can see the variety of claims for LIC and personal insurers

Is Declare Settlement Ratio a chance?

One of many largest myths about CSR (Declare settlement ratio) is that it’s a chance of declare settlement. This isn’t true and sometimes results in misjudgment of an insurance coverage firm.

CSR is just a approach of representing the info and nothing else. It doesn’t inform you concerning the intention of the corporate. Let me share this with an analogy

Think about there are two VISA processing counters that are paperwork of individuals and giving the VISA or rejecting it.

Now if the Visa can be accepted or rejected relies upon primarily on how correct are the paperwork and the individual and never depend upon the one that is processing the Visa. If the paperwork and case fall into the foundations set, then it will likely be accepted, else it is not going to.

So think about there are two counters A and B . Counter A rejects 5 individuals out of 100 and Counter B rejects 7 individuals out of 100.

Now, this merely signifies that counter A bought 5 individuals who didn’t match into the set guidelines or their paperwork had points. In the identical approach counter, B bought 7 individuals who had incomplete paperwork.

One can’t mistake these 93% (A) and 95% (B) because the chance of their visa getting rejected.

Therefore, in the identical approach, the declare settlement ratio simply tells you about what sort of claims did the insurance coverage firm acquired and what number of of these claims have been rejected. It’s not a chance.

Buyers principally have a really dangerous view of corporations and attribute these rejections to their intentions, which isn’t an accurate approach to take a look at this ratio.

Does Declare Settlement Ratio depend upon the policyholder?

Sure

A declare that can be rejected or accepted relies upon totally on the policyholder itself. There are numerous individuals who file a declare which is sure to get rejected because it’s not legitimate as per the phrases and situations of the coverage doc.

Many policyholders even have a really imprecise and mistaken impression of what’s lined and what’s not. They file claims primarily based on flimsy assumptions and for issues which can be out of the scope of guidelines.

Let me offer you an instance.

Think about an individual who lied to the corporate whereas taking a time period/medical health insurance, that he’s a smoker and in addition went via some surgical procedure in previous. He lied to the corporate.

After some years the declare was filed (individual died or bought hospitalized) and now the corporate finds out the data supplied by the insured individual was false and therefore the declare shouldn’t be paid on this case and it’s completely legitimate rejection.

So right here it’s not the corporate who had the mistaken intention however the buyer who created a state of affairs that led to assert rejection. A lot of the insurance policies that are rejected fall into this class.

Out of your finish, it’s a must to perceive one factor. When you have purchased your coverage correctly and revealed all the data correctly, your declare is not going to be rejected. Nonetheless, for those who give causes for the corporate to reject your claims, it should absolutely be rejected and there may be nothing mistaken with that.

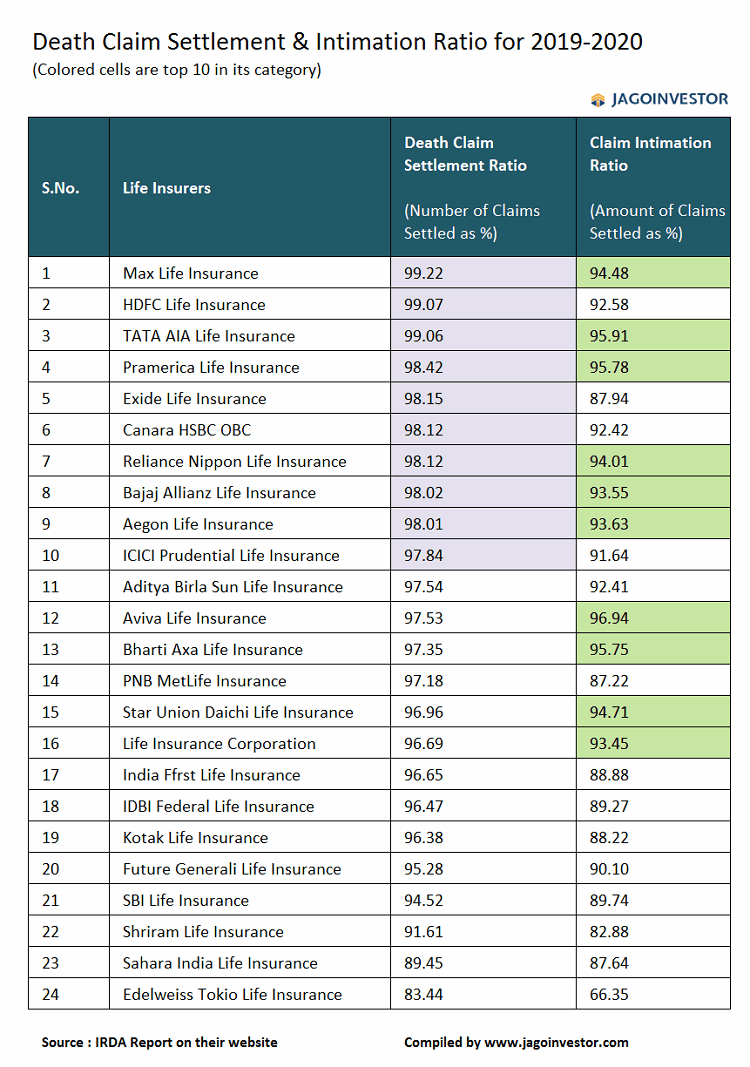

What’s Declare Intimation Ratio?

Declare Settlement Ratio tells you about “variety of insurance policies”, whereas Declare Intimation Ratio tells you concerning the “AMOUNT”

It tells you what share of the declare quantity was paid out of the entire declare quantity which was claimed in a yr.

Declare Intimation Ratio = (Quantity Paid / Whole Declare Quantity)

Most individuals usually are not conscious of this ratio, and this offers you higher readability concerning the claims paid by an organization. It might occur that an organization has a excessive declare settlement ratio, however its declare intimation ratio is decrease than the opposite firm.

Right here is an instance of how the Declare settlement ratio will be excessive regardless of a low intimation ratio

Firm A and B receives 10 claims in a yr as follows

- 9 claims of Rs 10 lacs every

- 1 declare of 1.1 crore

[su_table responsive=”yes”]

| Firm A | Firm B | |

|---|---|---|

| Declare Rejected | 1 declare of 1.1 crores is rejected | 2 claims of 10 lacs are rejected |

| Declare Settlement Ratio | 9/10 = 90% | 8/10 = 80% |

| Declare Intimation Ratio | 90 lacs / 2 crores = 45% | 1.8 crore / 2 crore = 90% |

| Remark | Declare settlement ratio is excessive, however not the quantity paid | Declare settlement ratio is low, however the greater quantity paid |

[/su_table]

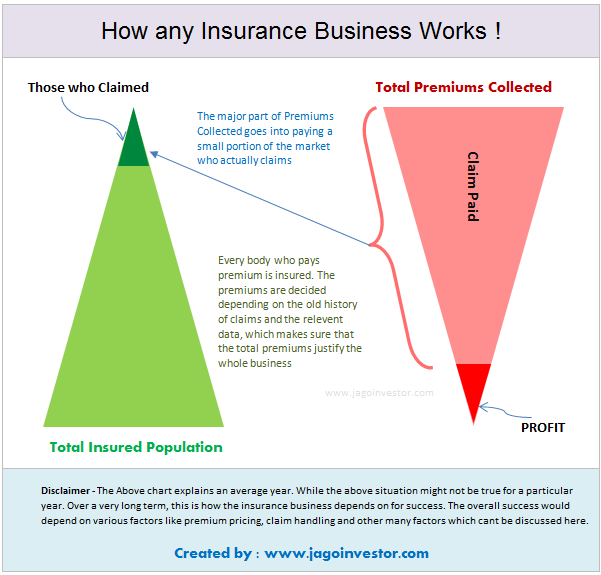

Enterprise Mannequin of an insurance coverage firm

As a buyer, you need to be very clear concerning the enterprise mannequin of an insurance coverage firm. An insurance coverage firm is a for-profit group whose intention is to remain worthwhile and work for its profitability and in addition serve its clients as effectively.

The insurance coverage firm collects a small premium from numerous individuals, however that cash ultimately goes solely to a handful quantity of people that file for a declare. So in a approach, it’s a shared useful resource which is given to those that are legitimate claimants.

With a view to keep in enterprise and be worthwhile, an insurance coverage firm has to reject all of the claims which aren’t legitimate. If they begin paying each declare with out correct verification, they simply gained’t survive and it’s not within the buyer’s curiosity.

This merely signifies that an organization with not one of the best declare settlement ratio, in actuality, is an efficient firm as a result of is aware of easy methods to shield itself and never let a fraudster make a mistaken declare.

A vital level to notice is {that a} new insurance coverage firm will principally be getting demise claims within the beginning 8-10 yrs and never any maturity claims which implies their declare settlement ratio could look on the decrease aspect.

Easy methods to purchase an insurance coverage coverage?

Mainly here’s a high-level step-by-step course of

- Have a look at an organization whose identify you belief

- Select an organization which has been few years outdated (this will depend on you)

- Select an organization whose product you want (options and so forth)

- Take a look at the expertise of different buyers on-line concerning the firm

- Purchase a coverage with full honesty and by disclosing all data

Don’t lose your sleep over Declare Settlement Ratio

Ultimately, I simply need to say that the declare settlement ratio shouldn’t be a helpful metric for any goal and you shouldn’t lose your sleep over it. Don’t fear an excessive amount of.