Picture supply: Getty Photographs

The AstraZeneca (LSE:AZN) share worth rose 2.5% yesterday (1 July) on information that the corporate is contemplating transferring its shares to the US. That’s been a well-liked theme for UK shares just lately.

CEO Pascal Soriot has been crucial of the UK’s method to drug firms. However I’m undecided transferring to the US could be an enchancment.

Worth controls

Growing new therapies is a dangerous and costly enterprise. And there’s an attention-grabbing query as to how corporations that do that efficiently – like AstraZeneca – must be compensated.

One of many issues Soriot has objected to is the UK’s worth controls, which restrict how a lot the NHS pays for therapies. But it surely’s arduous to see how issues are far more beneficial within the US.

Within the UK, the Nationwide Institute for Well being and Care Excellence (NICE) assesses medication – similar to Astrazeneca’s – for cost-effectiveness. This limits what the NHS is ready to pay for them.

NICE’s resolution to categorise metastatic breast most cancers as ‘reasonably extreme’ reasonably than ‘extreme’ has been unfavourable for AstraZeneca. However is the US prone to be extra profitable?

Robert F Kennedy – the present US Well being Secretary – has introduced plans to restrict drug costs. The acknowledged intention is to cease the US paying greater than different international locations for a similar therapies.

This makes it look rather a lot just like the US is transferring in the direction of the UK-style worth controls. And that would appear to restrict the extent to which it’s a extra enticing place for AstraZeneca to be listed.

Valuation

After all, one other main purpose UK shares have been transferring their listings throughout the Atlantic is valuation. The S&P 500 trades at a lot increased valuations than the FTSE 100 and that’s not an accident.

Itemizing within the US subsequently makes a variety of sense for firms that need to give their share costs a lift. However AstraZeneca is a wierd candidate from this attitude.

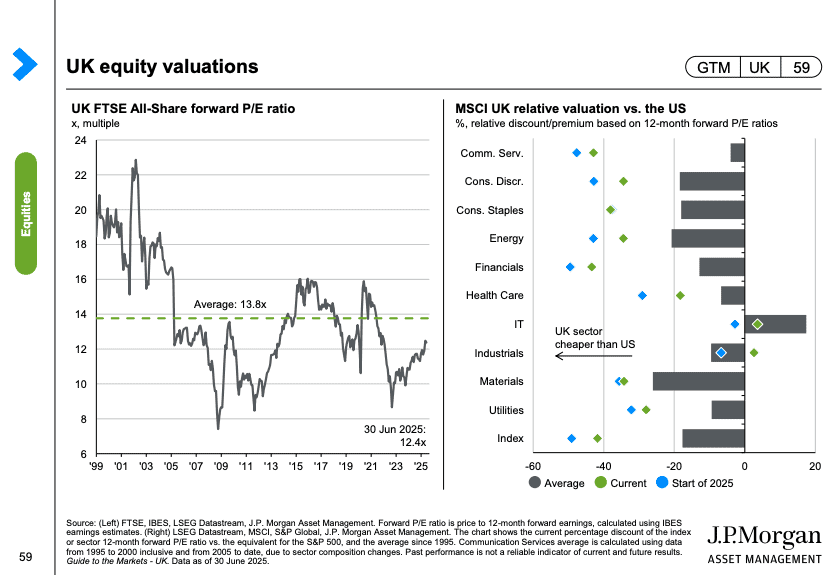

Supply: JP Morgan Information to the Markets UK Q3 2025

In keeping with information from JP Morgan, healthcare is without doubt one of the sectors the place the distinction in valuation is probably the most slim. And the hole has closed considerably for the reason that begin of the yr.

During the last 12 months, healthcare has been the only worst-performing sector for the S&P 500. And this has been exhibiting up within the multiples that US shares have been buying and selling at.

Pfizer, Merck, and Bristol-Myers Squibb all at the moment commerce at unusually low price-to-earnings (P/E) ratios. A superb quantity of that is the results of the altering regulatory setting within the US.

In contrast, AstraZeneca shares at the moment commerce at a P/E ratio of 27. That’s excessive by nearly any commonplace and makes it unlikely that transferring to the US would appeal to a a lot increased a number of.

I’m not satisfied

Decrease multiples and a notably hostile regulatory setting imply I’m not satisfied AstraZeneca has a lot to achieve by transferring to the US. However that may not be the plan.

Given the frustration Soriot has expressed at UK worth controls, discuss of leaving would possibly simply be a negotiating tactic to try to enhance issues. That appears to be the style for the time being.

In any occasion, I don’t assume AstraZeneca is about to unlock significant worth for shareholders by shifting its itemizing. This doesn’t appear to be a lot of a chance to contemplate to me.