Be a part of Our Telegram channel to remain updated on breaking information protection

The XRP value slumped 3.9% over the previous 24 hours to commerce at $2.49 as of three:46 a.m. EST on buying and selling quantity that plunged 8% to $5 billion.

This comes as Canary Capital filed an up to date S-1 for its sport XRP ETF (exchange-traded fund), eradicating the “delaying modification” that allowed the SEC to regulate the timing of the registration.

The transfer units the stage for a possible launch on November 13, pending Nasdaq’s approval of the 8-A submitting.

🚨SCOOP: @CanaryFunds has filed an up to date S-1 for its $XRP spot ETF, eradicating the “delaying modification” that stops a registration from going auto-effective and offers the @SECGov management over timing.

This units Canary’s $XRP ETF up for a launch date of November 13, assuming the… pic.twitter.com/MKvEN23t5P

— Eleanor Terrett (@EleanorTerrett) October 30, 2025

After the replace, the ETF now qualifies to take impact mechanically underneath part 8(a) of the 1933 Securities Act.

The transfer additionally comes at a time when the SEC Chair Paul Atkins has proven assist for corporations utilizing the auto-effective methodology, which Bitwise and Canary have used to launch their SOL, HBAR, and LTC ETFs.

Atkins praised using the 20-day statutory ready interval through the shutdown, which highlights its effectiveness in facilitating public choices.

With the up to date submission, Canary’s XRP ETF can transfer ahead and not using a formal SEC sign-off, and it seems able to proceed as soon as the statutory 20-day interval has handed. The one potential holdup can be if the SEC points extra feedback or issues.

XRP Value Actions Sign Potential Bearish Continuation

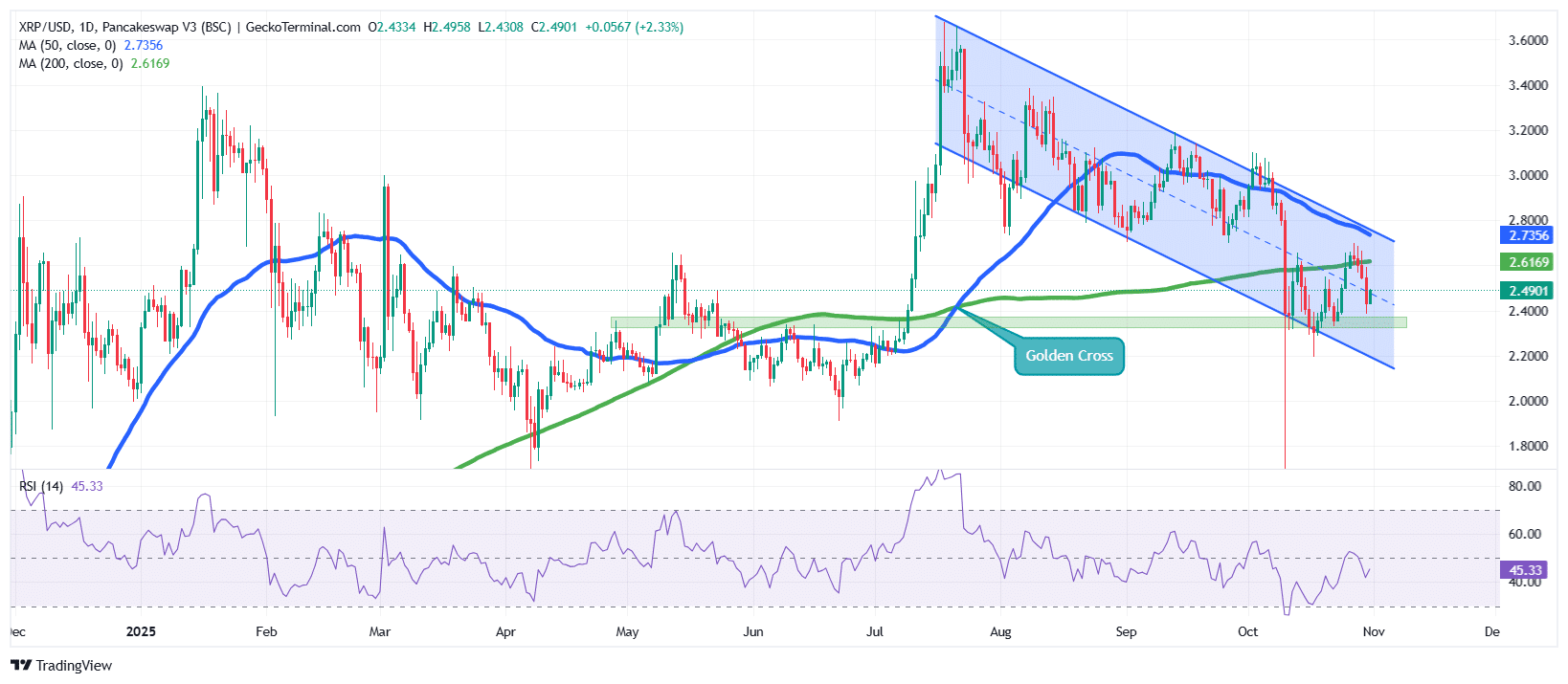

After a powerful rally in July that drove the XRP value towards the $3.30 zone, the momentum shifted as bears regained management, triggering a retracement that developed right into a falling channel sample.

All through this part, bulls have been trying to defend the $2.40–$2.45 assist space, however current market construction suggests sellers stay dominant.

The continuing correction has pressured the Ripple token value beneath its 50-day Easy Transferring Common (SMA), at present round $2.73, confirming that short-term momentum stays damaging. The 200-day SMA, at present round $2.62, is performing as a near-term pivot degree, and a break beneath it may open the door to additional draw back.

Regardless of the sooner Golden Cross (when the 50-day SMA crossed above the 200-day SMA), the current pullback has neutralized that bullish sign, suggesting XRP might have to retest deeper assist ranges earlier than any restoration try.

Moreover, the Relative Power Index (RSI) at present sits close to 45.3, reflecting diminished shopping for stress and a tilt towards bearish sentiment.

Ripple Token Targets Help Close to $2.35

Given the present technical setup, the XRP value seems poised to check its horizontal assist zone round $2.35, an space that has held a number of occasions in current months.

A decisive shut beneath this degree may see the Ripple token slide additional towards $2.20, which aligns with the decrease boundary of the descending channel.

Conversely, if bulls handle to defend the $2.40 zone and push the value of the Ripple token above $2.73 (the 50-day SMA), XRP may try a breakout towards the higher channel boundary close to $2.80–$2.85.

A confirmed shut above that vary can be the primary sign of a possible bullish reversal.

Associated New:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection