Be a part of Our Telegram channel to remain updated on breaking information protection

The XRP value rose a fraction of a % prior to now 24 hours to commerce at $2.79 as of 1:17 a.m. EST whilst buying and selling quantity plunged 58% to $2.8 billion.

This comes as six purposes for spot XRP exchange-traded funds (ETFs) are nearing determination deadlines.

The US Securities and Trade Fee (SEC) is anticipated to rule on them between October 18 and October 25, which is able to decide whether or not XRP turns into the third cryptocurrency after Bitcoin and Ethereum to realize entry to US-listed spot ETFs.

🔥 XRP ETFs might deliver big institutional inflows and push $XRP to new ATH $8-$10!

13 Issuers 💵

19 Merchandise 🎁 (9 Spot / 9 Futures)

10 Stay 🟢 | 9 Pending 🔴 pic.twitter.com/GiFEr1IpFr— XRP_Cro 🔥 AI / Gaming / DePIN (@stedas) September 27, 2025

Grayscale’s XRP ETF is scheduled for evaluation on October 18, 21Shares Core XRP Belief ETF on October 19, Bitwise’s XRP ETF on October 22, Canary Capital and CoinShares on October 23, and WisdomTree’s XRP ETF submitting on October 24.

Nate Geraci, the president of NovaDius Wealth Administration, says ”prepare for October” after optimistic regulatory developments within the final two weeks that included a collection of firsts that he detailed within the following put up:

Final 2 weeks…

First ETF providing spot xrp publicity

First ETF providing spot doge publicity

SEC approves generic itemizing requirements

First index-based spot crypto ETF

First eth staking ETF

First hype ETF submitting

Vanguard capitulates on spot crypto ETFs

Prepare for October.

— Nate Geraci (@NateGeraci) September 27, 2025

XRP At A Crossroads: Can Bulls Defend The Key Help Zone?

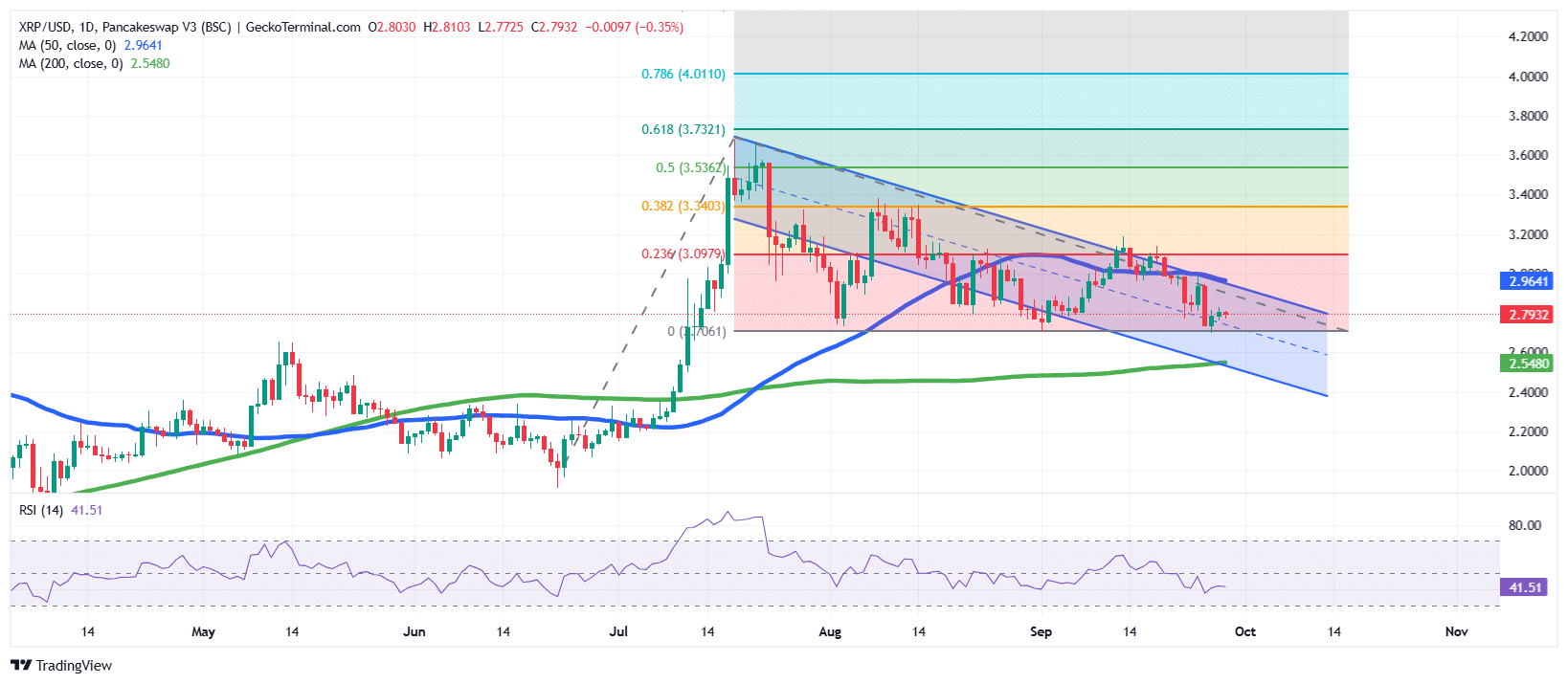

The XRP value on the every day chart exhibits a market below strain, buying and selling close to $2.79 after a gentle decline from its mid-July highs.

The Ripple token value motion has shaped a descending channel sample, reflecting a transparent bearish pattern in current weeks.

Every rally try has been met with promoting strain, conserving XRP locked beneath the channel’s higher resistance. XRP is hovering simply beneath the 50-day Easy Shifting Common (SMA) (at $2.96), whereas the 200-day SMA (at $2.54) stays an important long-term help stage.

The Fibonacci retracement from the July rally highlights resistance at $3.09 (23.6%), $3.34 (38.2%), and $3.53 (50%). These ranges stay crucial hurdles if XRP makes an attempt a restoration.

In the meantime, the Relative Power Index (RSI) at present sits at 41.5, putting it in bearish territory however not but oversold. This means there might nonetheless be room for additional draw back earlier than sturdy accumulation seems.

In the meantime, the 50-day SMA has crossed above the XRP value, performing as dynamic resistance, whereas the 200-day SMA stays supportive, making a battle between short-term bearishness and long-term pattern stability.

Wanting forward, XRP’s value motion will possible hinge on whether or not it could possibly maintain above the $2.55 help zone, which aligns with the 200-day SMA.

A breakdown beneath this stage might set off a deeper retracement towards $2.40.

On the upside, reclaiming $3.00 could be the primary sign of power, with a possible breakout above $3.34 opening the trail towards $3.53 and past. For now, XRP stays at a crossroads, with the market awaiting affirmation of its subsequent main transfer.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection