Zensar Greatest Firm Insights

For traders who wish to put money into the digital development story of India in addition to the worldwide development story, Zensar Applied sciences is without doubt one of the finest funding alternatives in that phase. Regardless of the autumn within the broader market of NSE and BSE, the Nifty IT index has given a month-to-month escape with a cup and deal with sample at 38,691 stage and sustaining the breakout stage.

On the day by day chart, the CNXIT index has been consolidating on the 42,000 stage for a while. As soon as the broader market recovers, the CNXIT index would be the first to provide a great return. This isn’t a suggestion however deal with this as an evaluation that helps your evaluation.

Zensar Share Worth Evaluation

I’m bullish on Zensar Tech based mostly on its comparatively low cost valuation in comparison with its friends, sturdy ahead steerage targeted on sustainable development, and leveraging its strengths in client-centricity, and innovation.

Allow us to analyze the corporate from its efficiency and future outlook.

Zensar Greatest Firm Insights to Make investments

Zensar Tech is without doubt one of the main digital options and expertise companies corporations with strong monetary efficiency, strategic imaginative and prescient, and its place inside the rising expertise sector. Zensar Applied sciences is part of the RPG Group, a worldwide conglomerate with a various portfolio spanning numerous sectors. This offers consolation to traders trying to faucet right into a high-potential IT firm.

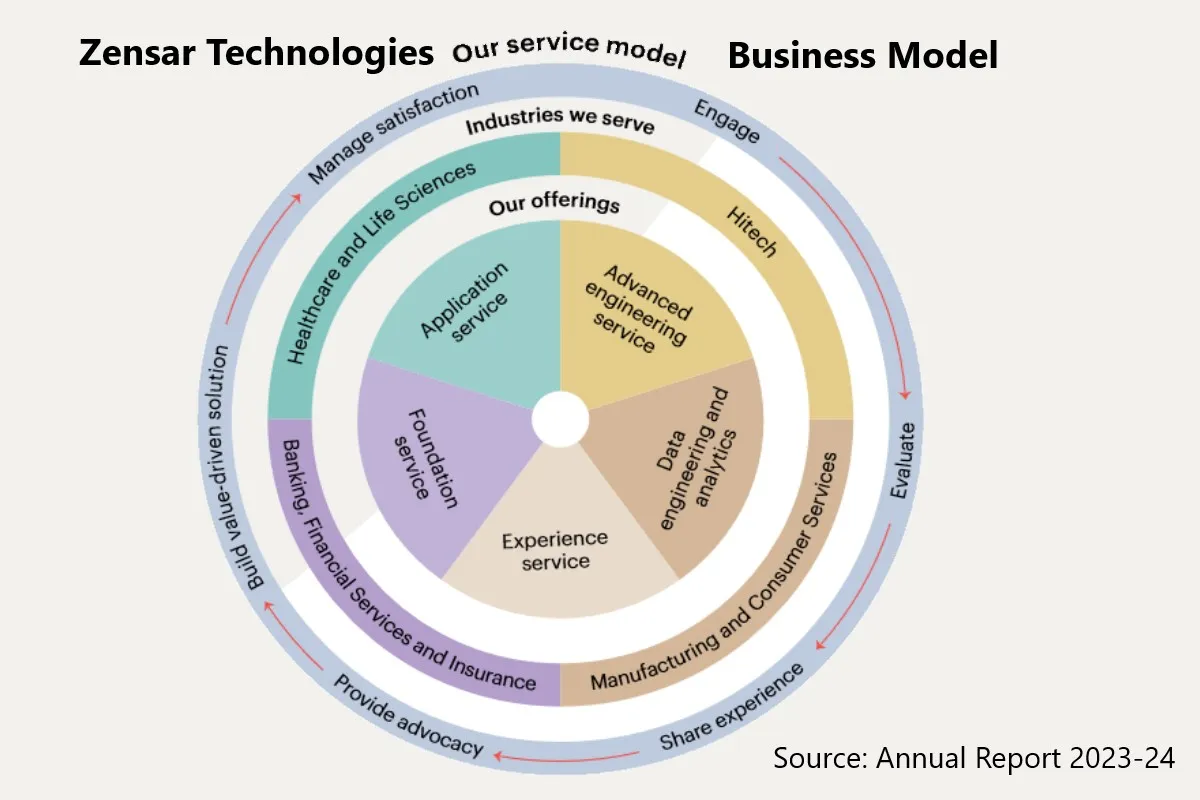

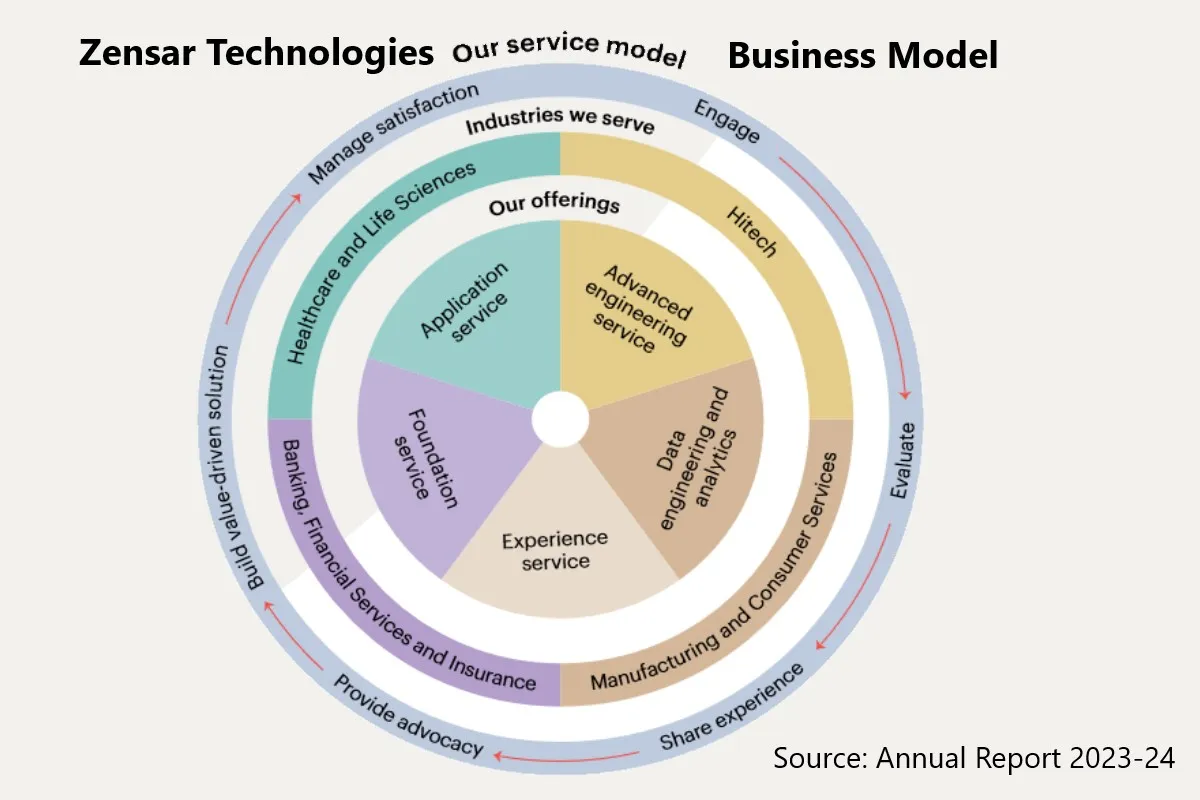

Zensar’s Enterprise Segments

Zensar Applied sciences focuses on two enterprise segments:

- Digital and Software Providers (DAS): Digital Software Providers constituted the most important portion at 79.7% of income in Q2 FY25. This was adopted by Cloud Infrastructure and Safety at 20.3%, indicating a rising deal with these areas.

- Digital Basis Providers (DFS): In FY24, DFS contributed INR 9,000 million to Zensar’s whole income. This represents 18.4% of the corporate’s whole income for that monetary 12 months.

- When it comes to income by vertical, Banking and Monetary Providers (BFSI) constituted the most important phase at 40.9% in Q2 FY25. This means a powerful reliance on the BFSI sector for Zensar’s income technology.

Digital Options and Know-how Providers Market Measurement

The worldwide IT spending is anticipated to succeed in $5 trillion in 2024, representing a 6.8% improve from 2023. IT companies will doubtless be the most important spending phase for the primary time, reaching $1.5 trillion in 2024, with an 8.7% development pushed by the financial restoration of the U.S. and Europe.

The worldwide AI market is projected to succeed in $320-380 billion by 2027. Generative AI (GenAI) is anticipated to contribute to about one-third of this market worth.

The Indian fintech market is anticipated to succeed in USD 2.1 trillion by 2030. India’s AI market is predicted to develop at a compound annual development price (CAGR) of 25-35% till 2027, pushed by a sturdy AI expertise pool and investments.

In 2023, 70% of world enterprises allotted not less than 20% of their expertise finances to digital initiatives, a notable improve from 57% in 2022. This pattern signifies the rising demand for digital options and expertise companies. This finances is anticipated to go up from 2025 to 2030 pushed by AI and rising digital companies.

Zensar Tech Share Worth Evaluation

Allow us to focus on some key the explanation why Zensar Applied sciences stands out as a first-rate funding selection.

Zensar Applied sciences Restricted Efficiency Abstract

- Zensar Applied sciences income for the 12 months was Rs. 4,901 crore, a development of 1% from the earlier 12 months. The corporate has accomplished exceedingly effectively on the profitability entrance, pushed by initiatives like enchancment in useful resource utilization, rationalization of sourcing price, pyramid optimization, and improved price management.

- For Q1 FY25, the corporate had income of Rs. 1,288 crore, a 5% improve from Rs. 1,227 crore in Q1 FY24. The corporate’s internet revenue was near Rs. 158 crore.

- Zensar is dedicated to long-term development and plans to develop its attain, refine companies, and construct a stronger portfolio of modern options.

- Zensar’s operations are primarily situated in the USA, Europe, and South Africa. The corporate is pursuing price optimization methods throughout operations to make sure sustained development and monetary stability.

- Zensar has no excellent debt. The corporate’s short-term credit standing was reaffirmed at A1+ and its long-term credit standing was reaffirmed at AA+ by ICRA.

- The corporate’s administration has dedicated to making sure sustainable margins. Zensar intends to handle its working capital successfully and improve budgetary controls to attain this.

Zensar Tech share value goal

As an alternative of giving Zensar Tech share value goal, I would like to do Zensar Tech share value evaluation whereas analyzing the corporate’s efficiency from all angles so that you could resolve on Zensar Tech share value goal.

Zensar Applied sciences Income Rising Persistently

Zensar Applied sciences has demonstrated regular income development through the years, regardless of dealing with macroeconomic challenges. For Q2 FY25, the corporate reported income of $156.2 million, reflecting a 4.0% year-over-year (YoY) development in reported foreign money and three.3% in fixed foreign money.

It is a testomony to the corporate’s resilience and its capacity to navigate the complexities of the worldwide IT companies business, offering steady worth to its stakeholders.

The corporate has additionally achieved sturdy sectoral development, notably in Banking, Monetary Providers & Insurance coverage (BFSI), and Healthcare & Life Sciences, reporting YoY development charges of 14.0% and 13.3%, respectively.

These sectors symbolize secure, high-demand industries, offering Zensar with a gradual stream of enterprise and long-term development potential.

Robust Profitability and Operational Effectivity

Zensar’s profitability metrics are equally spectacular, with the corporate reaching an EBITDA margin of 15.4% in Q2 FY25. Zensar has efficiently applied a number of initiatives, together with optimizing its supply mannequin, which has helped in enhancing profitability.

As well as, Zensar’s revenue after tax (PAT) stood at 11.9% in Q2 FY25, and the corporate’s disciplined method to managing prices has resulted in a wholesome stability sheet. With money and money equivalents of $255 million, the corporate is well-positioned to put money into future development alternatives with out compromising monetary stability.

Zensar Share Worth Valuation

Zensar Share Worth Valuation is relying on the corporate’s market cap, monetary efficiency, and future outlook. Allow us to focus on one after the other.

Zensar Market Capitalization

- As of September 30, 2024, Zensar Applied sciences had a market capitalization of INR 15,311 crores, equal to roughly USD 1.86 billion utilizing the present trade price (as of November 13, 2023).

- This market cap determine represents the entire worth of all excellent shares of Zensar Applied sciences.

Zensar Applied sciences income

- Zensar’s monetary efficiency can be utilized to evaluate its valuation.

- Income (FY24): INR 49,019 million (roughly USD 592.3 million).

- PAT (FY24): INR 8,030 million (roughly USD 80.3 million).

- EBITDA Margin (FY24): 17.8%.

- Income Progress (FY24): 1% YoY in USD phrases.

- Order E-book (Q2 FY25): Highest ever, indicating constructive future income potential.

Zensar Shareholder Construction

- The promoter group holds a big stake in Zensar Applied sciences, proudly owning 49.1% of the excellent shares as of September 30, 2024.

- This excessive promoter holding can point out confidence within the firm’s prospects.

Robust Order E-book and Consumer Wins

Probably the most encouraging indicators of Zensar’s long-term development prospects is its sturdy order guide. Zensar Applied sciences has 15 shoppers that spend over $10 million yearly. In Q2 FY25, the corporate secured important new enterprise wins, together with:

- Software modernization for a worldwide sustainable expertise shopper.

- Finish-to-end IT operations transformation for a UK-based specialist banking firm.

- Cloud transformation for one of many largest malls within the USA.

- These strategic wins point out Zensar’s capacity to draw and retain massive shoppers, positioning the corporate as a dependable associate for world enterprises.

- The corporate’s highest-ever order guide in Q2 FY25 additionally indicators continued momentum in its core enterprise.

Progressive Options and Future-Prepared Providers

Zensar is dedicated to driving innovation by its digital choices. The corporate is targeted on delivering cutting-edge options throughout key service traces, resembling cloud transformation, AI, and knowledge engineering. Zensar presents a set of companies leveraging generative AI, together with the event of customized AI fashions and instruments. This enables shoppers to harness the facility of generative AI for numerous purposes.

Zensar offers complete cloud transformation companies, together with migration, utility modernization, and ongoing cloud administration. Zensar’s deal with modern options and future-ready companies, notably in areas like AI, cloud computing, and digital engineering, highlights its dedication to helping shoppers in navigating the evolving digital panorama.

These choices place Zensar as a strategic associate for companies searching for to remodel their operations and thrive in a technology-driven world.

Additionally Learn: Anant Raj Restricted: The Greatest Technique to Spend money on Information Middle Shares in India

Zensar Management

Zensar has an skilled management staff with numerous ability units. For instance, Manish Tandon, the CEO and Managing Director, has in depth expertise within the IT business, and Harsh V. Goenka, the Chairman, brings a wealth of expertise from main RPG Enterprises. The Board of Administrators includes a mixture of government and impartial administrators with experience in numerous areas. The corporate’s deal with constructing a client-centric group, mixed with operational excellence, has been instrumental in its current successes.

Strategic Concentrate on Excessive-Progress Sectors

- Zensar’s strategic deal with high-growth verticals, together with BFSI, healthcare, and manufacturing, positions it effectively for future development. The BFSI sector, specifically, has emerged as a powerful income driver, grew by 9.3% contributing 37.7% of whole income in FY24.

- Healthcare and Life Sciences (HLS): HLS has additionally proven constant development for Zensar. In Q2FY25, it recorded a sequential QoQ income development of 8.8% and a YoY development of 13.3%.

- The corporate’s geographic diversification, with a powerful presence in North America, Europe, and Africa, additional mitigates dangers and offers entry to a broad shopper base throughout key markets.

Geographical Presence of Zensar Applied sciences

- The US is Zensar’s largest market, contributing the vast majority of its income. In FY24, the US accounted for 67.2% of whole income.

- Europe is Zensar’s second-largest market, producing 20.8% of whole income in FY24. Zensar’s presence in Europe has grown, marked by wins throughout each present and new shoppers.

- South Africa represents Zensar’s third-largest market, accounting for 12.0% of whole income in FY24. Just like Europe, Zensar has witnessed development in South Africa, buying new shoppers and increasing its operations.

Service Line Enlargement

Zensar goals to broaden its service choices by including new capabilities, particularly in Enterprise-as-a-Service (EaaS) and Superior Engineering Providers (AES). These service traces are essential for addressing the evolving wants of shoppers in areas like automation, cloud computing, and digital transformation.

The corporate can also be specializing in Generative AI (GenAI) options and companies. For instance, Zensar focuses on VISCA – an image-based search answer leveraging GenAI to enhance person expertise. Zensar can also be exploring the usage of GenAI to create immersive banking experiences inside digital environments.

Last Phrases on Zensar Share Worth

Zensar Applied sciences presents a powerful funding alternative, backed by its strong monetary efficiency, dedication to innovation, and deal with sustainability. The corporate’s capacity to safe massive offers, develop its service choices, and ship constant profitability makes it a pretty proposition for traders trying to profit from the expansion potential of the IT companies sector.

With its strategic deal with key verticals, strong order guide, and disciplined execution, Zensar is well-positioned to proceed delivering worth to shareholders within the coming years.