Be part of Our Telegram channel to remain updated on breaking information protection

Native Markets will take a look at Hyperliquid’s USDH stablecoin inside days after a group vote selected it over rivals together with Paxos and Frax.

“We will probably be deploying each the USDH HIP-1 and corresponding ERC-20 inside days,” stated founder Max Fiege in a publish on X.

We will probably be deploying each the USDH HIP-1 and corresponding ERC-20 inside days.

We’ll then begin with a testing part for mints and redeems of as much as $800/tx with an preliminary group, to be adopted by the opening of the USDH/USDC spot order e book in addition to uncapped mints &…

— max.hl (@fiege_max) September 14, 2025

The win got here after Ethena withdrew from the competition final week, giving Native Markets a transparent path to choice.

After preliminary deployment within the coming days, Native Markets will kick off the testing part for mints and redeems for the USDH stablecoin. Feige stated that the greenback quantities per transaction will initially be capped at $800, and this testing part will solely embody “an preliminary group.”

As soon as that testing stage is full, Native Markets will then open up “the USDH/USD spot order e book in addition to uncapped mints & redeems,” the challenge’s founder added.

He stated anybody buying and selling massive volumes on Hyperliquid who needs to check the API throughout this early part can attain out to the crew straight.

We will probably be deploying each the USDH HIP-1 and corresponding ERC-20 inside days.

We’ll then begin with a testing part for mints and redeems of as much as $800/tx with an preliminary group, to be adopted by the opening of the USDH/USDC spot order e book in addition to uncapped mints &…

— max.hl (@fiege_max) September 14, 2025

Native Markets Secures Vote Amid Backlash From Crypto Group

Native Markets is a comparatively new entity that was based by Feige, who’s a Hyperliquid investor and adviser.

In its proposal, the challenge positioned itself as a “Hyperliquid-native” possibility. It additionally highlighted that Native Markets is already deeply aligned with the Hyperliquid ecosystem, governance and technical stack.

Main as much as the ultimate phases of the voting course of, there have been some within the crypto group that claimed the method was rigged from the get-go.

These critics argued that validators had predisposed in favor of Native Markets, including that the method had been tilted to favor Native Markets whereas different bidders barely had a good period of time to submit their very own proposals.

Beginning to really feel just like the USDH RFP was a little bit of a farce.

Listening to from a number of bidders that not one of the validators are concerned with contemplating anybody moreover Native Markets. It is not even a severe dialogue, as if there was a backroom deal already achieved.

Native Markets’… pic.twitter.com/qrc9xChv6z

— Haseeb >|< (@hosseeb) September 9, 2025

Different critics targeted on how brief the voting window was. This put tasks that weren’t already linked to the Hyperliquid ecosystem at an obstacle, as a result of they didn’t have sufficient time to point out the group why they’d be a great match for the Hyperliquid stablecoin, the critics argued.

Different analysts and group members additionally expressed issues round Native Markets having no prior expertise of issuing a stablecoin. Though the challenge has partnered with recognized gamers like Stripe, Bridge, BlackRock, and others, some group members nonetheless really feel the dearth of direct stablecoin expertise presents a threat.

USDH Enters Aggressive Stablecoin Market

Whatever the controversy across the USDH voting course of, Feige has already stated that the Native Markets crew goals to show itself to the group.

USDH will enter a aggressive market, particularly after extra gamers entered the stablecoin house following US President Donald Trump’s signing of the GENIUS Act in July.

The invoice is the primary laws on the federal stage that establishes guidelines for each home and offshore stablecoin issuers seeking to situation their tokens within the US.

At present dominated by the likes of Tether (USDT) and Circle’s USD Coin (USDC), the stablecoin market has seen its capitalization enter a gradual climb after the GENIUS Act signing.

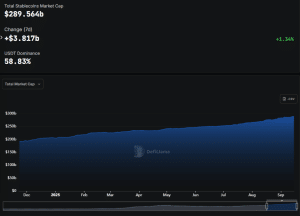

DefiLlama information exhibits that because the center of July, the stablecoin market cap has risen from round $259.905 billion to $289.564 billion as we speak. That is after the capitalization for these tokens soared greater than $3.81 billion in simply the final week.

Stablecoin market cap (Supply: DefiLlama)

USDT is the dominant stablecoin within the house, with a 58.83% share of the market and a capitalization of roughly $170.29 billion. The subsequent-biggest stablecoin is USDC, with a market cap of about $73.1 billion.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection