Picture supply: Getty Pictures

Grainger (LSE:GRI) is a UK-listed actual property funding belief (REIT). With its shares priced at £1.94, it presents traders a strategy to get a foot on the property ladder with lower than £2.

It’s no secret that the toughest a part of shopping for a home is commonly getting the deposit collectively as costs simply preserve going up. However I believe this could possibly be a wise strategy to try to construct some wealth to assist the method.

Constructing a deposit

Attempting to place collectively a deposit to purchase a home is usually a soul-destroying expertise and everyone knows why. Regardless of increased rates of interest in the previous couple of years, property costs simply preserve going up.

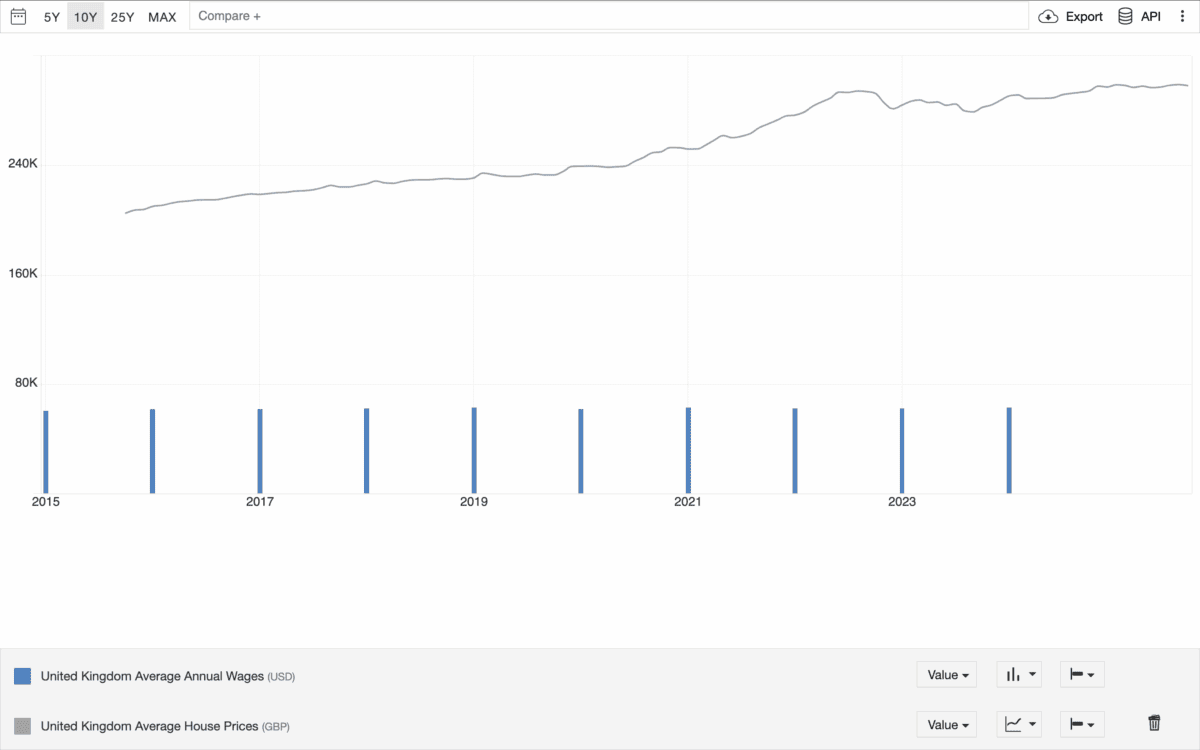

Within the final 10 years, the typical home value within the UK is up by round 50% and the typical wage has elevated by about 4%. Neglect Netflix, health club subscriptions, and no matter else — that equation simply doesn’t work.

Supply: Buying and selling Economics

There are many theories about why property costs preserve going up – I definitely have mine – however that’s a dialog for one more day. What issues proper now could be what to do about it.

To keep away from being left behind, future first-time consumers want one thing that may preserve tempo with rising home costs. And I believe Grainger is nicely price trying out as a possible reply.

A ready-made portfolio

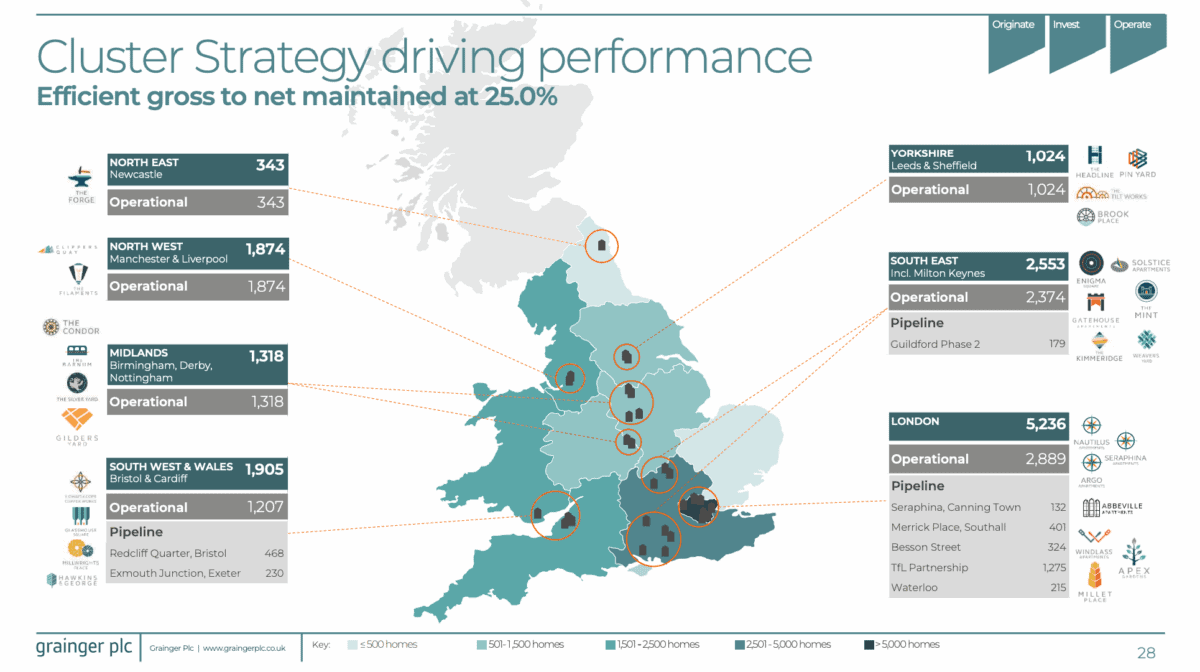

Grainger owns and leases a portfolio of over 11,000 homes throughout the UK. And round half of those are situated in London, the place demand all the time appears to be exceptionally robust.

Supply: Grainger Investor Relations

Put merely, it is a approach of investing in property. So until one thing unusual occurs, an funding within the firm ought to develop as the worth of its portfolio will increase with rising home costs.

There are a couple of the explanation why it won’t. One is the potential of altering rental laws producing a whole lot of unexpected prices if Grainger has to maintain modifying its buildings.

Different issues being equal although, an funding within the agency ought to have the ability to preserve tempo with a rising property market. And we haven’t even bought to what I believe is the perfect bit.

Rental earnings

As a REIT, Grainger is required to return 90% of its taxable earnings to shareholders. So traders don’t simply take part in rising property costs, in addition they get money dividends from the enterprise.

Please word that tax therapy relies on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for info functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation.

Dividends are by no means assured, however have been rising steadily over the past decade. And the corporate stories that a whole lot of its tenants have a tendency to remain in its properties for the long run.

Grainger additionally has huge plans for future growth. A future pipeline price round £1.3bn means it’s wanting so as to add one other 37% to the worth of its present portfolio.

In a market the place costs solely appear to go increased, that could possibly be price rather a lot. And traders can take part on this development by shopping for shares within the firm while not having an enormous deposit.

In case you can’t beat ’em…

It looks like first-time consumers within the UK are at a structural drawback – they usually have been in recent times. However investing in property by way of REITs is an concept that’s nicely price fascinated about.

Proudly owning shares in Grainger might assist future consumers keep away from being left behind by rising home costs whereas incomes passive earnings on the aspect. And it’s not the one alternative price contemplating.

platform quickly has gained recognition due to its innovative technologies and user-friendly interface, thanks to which https://thedebtsolvers.com/explore-the-future-of-trading-with-primexbt-online-3/ has attracted short term huge user base.

Суррогатное материнство – технология репродукции мужчины, при которой женщина добровольно соглашается забеременеть в целях выносить и родить биологически чужого ей ребёнка, https://docs.brdocsdigitais.com/index.php/%D0%A1%D0%BC%D1%8B%D1%81%D0%BB_%D0%A1%D0%BB%D0%BE%D0%B2%D0%B0_%D0%9C%D0%B0%D0%BC%D0%B0:_%D0%A7%D1%82%D0%BE_%D0%AD%D1%82%D0%BE_%D0%A2%D0%B0%D0%BA%D0%BE%D0%B5 что будет затем отдан на воспитание третьим лицам – генетическим родителям.

Website https://kairblog.ru/kak-vybrat-metizy/

Before I got married, I often finished the [url=https://3dira.com/casino3/loco777casino-guia-completa-para-jugadores-2/]https://3dira.com/casino3/loco777casino-guia-completa-para-jugadores-2/[/url] with friends and people couldn’t fell asleep. We went skiing whole day and played gambling all night, or played constantly when stayed in this house, like Vegas.

Website backlinks SEO

We are available by the following keywords: links for site promotion, links for SEO purposes, Google backlinks, link development, link builder, get backlinks, link service, site backlinks, acquire backlinks, backlinks via Kwork, backlinks for websites, website SEO links.

Could strategically investing in shares through an ISA potentially double your retirement income, and if so, what are the key factors to consider for such an investment?

Hope this isn’t too off-topic 🙂

Just recently I stumbled on a site called [url=https://news.veryuseful.website/]news.veryuseful.website[/url].

It’s packed with mind-blowing achievements.

Usain Bolt’s 9.58 seconds?

Phelps’ 28 Olympic medals?

Bubka’s 35 world records?

It’s all there.

Do you like sports facts too?