Be a part of Our Telegram channel to remain updated on breaking information protection

The Ethereum value plunged 5% within the final 24 hours to commerce at $3,315 as of two:26 a.m. EST on buying and selling quantity that rose 46% to $71 billion.

That ETH value drop comes as 10x Analysis advisable shorting Ether as a possible hedge in opposition to Bitcoin.

In accordance with the agency, there are structural dangers inside the Ethereum community. The analysis agency additionally famous a decline in institutional demand as key elements influencing technique. This comes at a time when Bitcoin continues to draw treasury capital, and Ethereum-focused firms are on the verge of operating out of capital to put money into the asset.

In accordance with 10X Analysis, that makes ETH a possible shorting alternative for buyers trying to hedge their publicity to the digital asset sector.

LATEST: ⚡ 10x Analysis has recognized Ethereum as a possible shorting alternative, highlighting structural weaknesses as Bitcoin continues to seize the vast majority of institutional treasury capital. pic.twitter.com/s79Jgc0fy8

— CoinMarketCap (@CoinMarketCap) November 5, 2025

The analysts stated that “digital asset treasury” narratives round Ethereum have led establishments to build up ETH and later distribute it to retail buyers, a sample now breaking down amid a scarcity of transparency in non-public funding in public fairness (PIPE) disclosures and unsure capital flows.

10x Analysis then referred to BitMine, noting that the agency’s technique has allowed for institutional buyers to build up ETH at par and later distribute it to retail patrons at a premium, a suggestions loop that continued to drive costs larger.

Ethereum Worth Checks Key Assist After Rounded High Breakdown

The ETH value has lately entered a bearish section following a robust rally earlier in 2025.

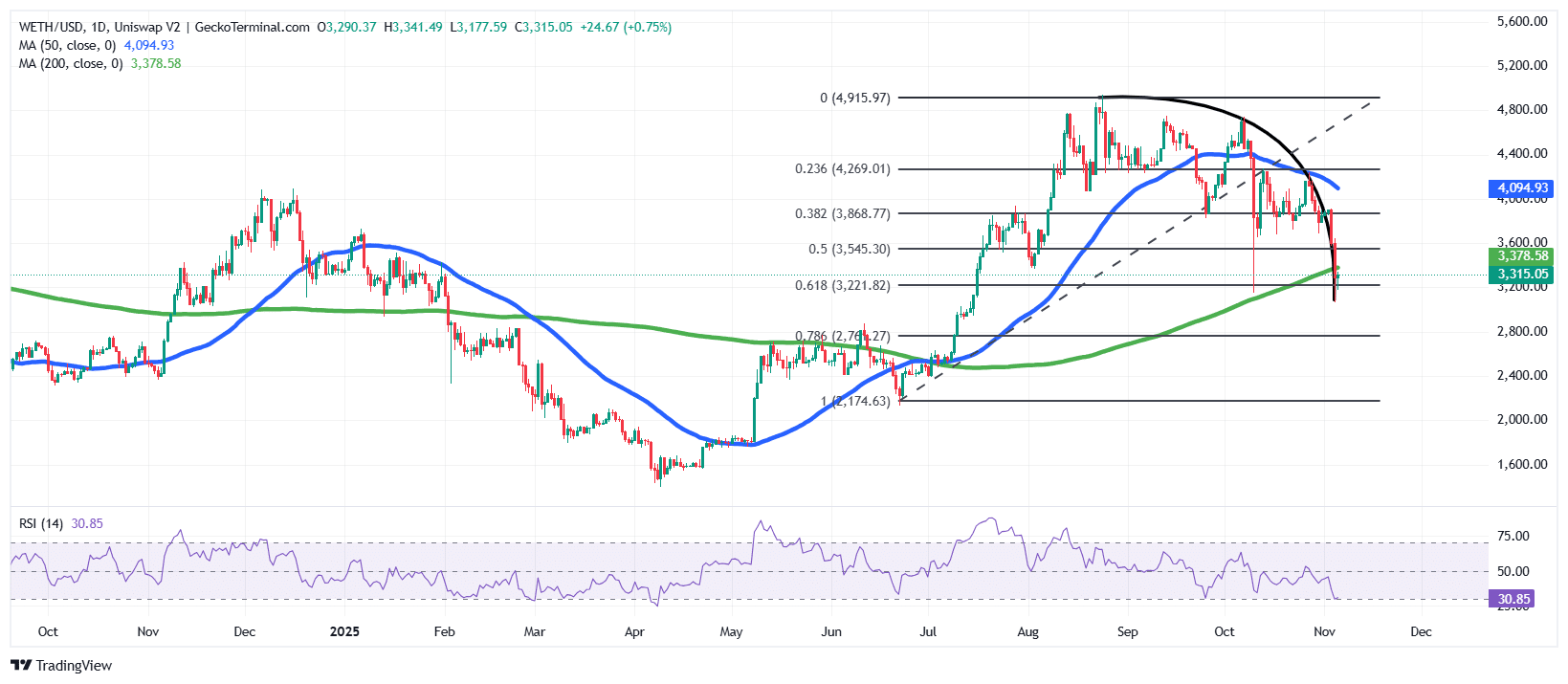

After reaching an area excessive close to $4,915, the Ethereum value fashioned a rounded high sample, which signifies a shift in momentum from bullish to bearish.

The worth of ETH has since declined sharply, breaking beneath each the $4,400 and $3,800 ranges, and is now testing the $3,200–$3,300 help zone.

That zone aligns with the 0.618 Fibonacci retracement stage ($3,221) from the earlier rally, which is an important level the place patrons usually try to regain management.

The 1-day chart additionally exhibits that ETH has fallen beneath its 50-day Easy Shifting Common (SMA) at $4,094, whereas at present sitting close to the 200-day SMA at $3,378, an essential long-term pattern indicator. If bulls handle to defend this help and push costs again above $3,500, it might verify a possible rebound and stop a deeper correction.

The Relative Energy Index (RSI) at present stands round 30.86, close to the oversold area, which exhibits that bears have management of the value.

In the meantime, the Shifting Common Convergence Divergence (MACD) indicator continues to help the bearish momentum, with the blue MACD line nicely beneath the orange sign line.

ETH Worth Outlook: Bears In Management, However Bounce Attainable

From a technical perspective, the pattern stays bearish so long as the ETH value trades beneath each the 50-day and 200-day SMAs. The speedy resistance lies round $3,545 (the 0.5 Fibonacci stage), adopted by $3,868.

A day by day shut above these ranges might mark the beginning of a short-term restoration towards $4,000–$4,200.

Conversely, if the $3,200 help stage fails to carry, the following draw back goal lies close to $2,780–$2,800.

Total, Ethereum’s chart construction signifies a market at a essential juncture, with bears in management, but technical indicators trace at an upcoming oversold reduction bounce.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection