Abstract Factors:

- I clarify the 4 quadrants: E, S, B, I.

- E and S imply buying and selling time for cash.

- B and I give attention to methods and passive revenue.

- I share my journey from E to B and I.

- Small steps may help you progress to monetary freedom.

Introduction

At the moment, I wish to discuss one thing that utterly modified how I take into consideration cash and monetary independence. It’s an idea I first got here throughout in Robert Kiyosaki’s ebook “Wealthy Dad’s Information to Investing“, the Money Circulate Quadrant, or what he calls the ESBI Mannequin.

I do know many people in India dream of economic freedom, however usually we don’t know the place to start out. So, permit me to clarify to you from what I’ve learnt from this ebook of Robert Kiyosaki.

Once I began my funding journey in 2008 (test right here my Journey), impressed by Kiyosaki’s Wealthy Dad Poor Dad, I used to be a mechanical engineer working a company job. Again then, I believed a great wage was the important thing to a safe life. However after studying Kiyosaki, I realised there’s an even bigger image. The Cashflow Quadrant helped me see how folks earn cash and why some turn into financially free whereas others keep caught.

On this put up, I’ll share with you ways I’ve perceived the concept of Cashflow Quadrants (ESBI Mannequin). I’ll fist present you how I visualize and keep in mind the ESBI Mannequin in my thoughts. Then, I’ll inform you how it’s serving to me to rework my life from mediocrity to monetary independence. Sure, if we will perceive the ESBI mannequin, it has powers to rework our lives.

So, let’s dive into this concept and see what it will possibly train us.

What Is the Money Circulate Quadrant?

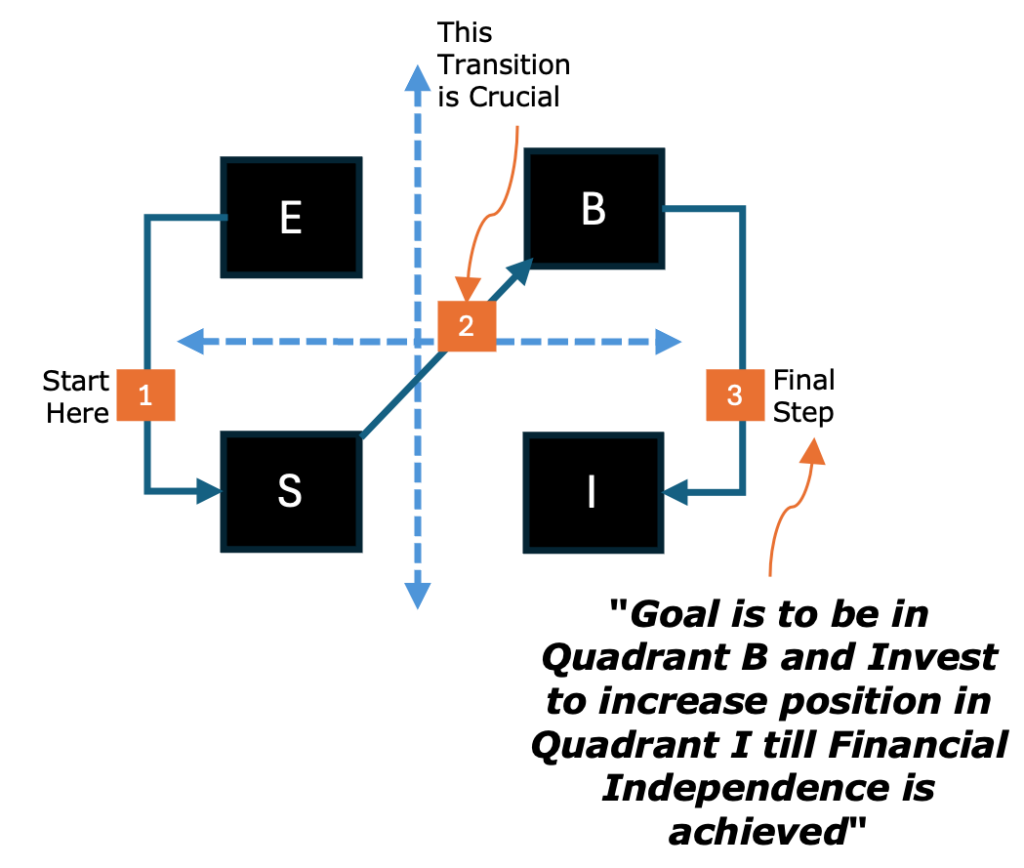

Think about a sq. divided into 4 elements. That is the Cashflow Quadrant, and every field represents a distinct approach folks earn cash. Kiyosaki calls these containers E, S, B, and I.

Robert Kiyosaki would need you to visualise the 4 quadrants like beneath:

Let me clarify what every one means.

- The “E” quadrant stands for Worker. That is the place most of us begin, like I did. When you work for a corporation, whether or not you’re a manufacturing unit employee, a software program engineer, or perhaps a CEO, you’re within the E quadrant. Your revenue comes from a wage, and also you commerce your time for cash. When you don’t work, you don’t receives a commission. Its easy, proper. For folks on this quadrant, “time is cash.”

- Then the “S” quadrant, which stands for Self-Employed. These are individuals who work for themselves. Consider your native physician, a lawyer, and even the grocery store proprietor of your neighbourhood. They don’t have a boss, however they nonetheless commerce their time for cash. In the event that they cease working, their revenue stops too. Kiyosaki additionally calls this the “solo and good” quadrant as a result of many professionals like accountants or consultants fall right here. At current I’m right here [solo but not smart 😊]

Now, let’s transfer to the opposite facet of the quadrant, the B and I containers.

- The “B” quadrant stands for Enterprise Proprietor. These are individuals who personal a system or an organization the place others work for them. Consider somebody who owns a sequence of eating places or a giant manufacturing unit. They don’t need to work daily as a result of their crew retains the enterprise operating, and so they earn income from that.

- Lastly, “I” stands for Investor. That is the place cash works for you. Buyers put their cash into issues like shares, actual property, or mutual funds, and so they earn passive revenue. What’s passive revenue? It’s the cash that is available in even once they’re sleeping. For instance, should you personal a flat and hire it out, that hire is passive revenue.

Why Does This Matter to Us?

You is likely to be questioning, “This sounds attention-grabbing, however why ought to I care about these quadrants?”

Good query.

Once I first examine this in Wealthy Dad’s Information to Investing, I used to be caught within the E quadrant, working lengthy hours in my company job. I believed I used to be doing effectively as a result of I had a gentle wage. However Kiyosaki made me realise one thing vital, folks within the E and S quadrants are restricted by time. There are solely 24 hours in a day, and irrespective of how exhausting you’re employed, you possibly can’t earn greater than what your time permits.

Within the ebook, Kiyosaki shares a narrative the place his wealthy dad tells him, “Within the E and S quadrants, you play the sport as a person, however within the B and I quadrants, you play as a crew.” This sentence has caught with me since.

I considered how, in my job, I used to be all the time working alone (a minimum of it appeared like that) to satisfy the deadlines.

Even once I began running a blog, I began within the S quadrant. writing each put up myself, managing all the things by myself. It was exhausting. However within the B and I quadrants, you construct methods or investments that be just right for you.

That’s once I understood why so many rich folks give attention to companies and investments as a substitute of simply jobs.

The Actuality of E and S Quadrants

Let’s speak a bit extra concerning the E and S quadrants as a result of that’s the place most of us are.

When you’re an worker, you’re buying and selling your time for a wage. It feels safe, in spite of everything, you get a set cash in your financial institution each month. However Kiyosaki factors out an issue: you don’t have a lot management over your revenue.

If the corporate shuts down otherwise you lose your job, your revenue stops. I noticed this in the course of the 2020 COVID crash when many misplaced their jobs in a single day. It made me realise how dangerous the E quadrant could be, even when it feels secure.

The S quadrant is a bit higher since you’re your individual boss.

I do know many self-employed folks in India, small shopkeepers, freelancers, even a detailed member of the family who runs his personal boutique. They’ve extra freedom than workers, however they’re nonetheless tied to their work. In the event that they takes every week off, their enterprise can’t earn something. Kiyosaki says it’s because S quadrant individuals are “additionally solo gamers like folks in E.”

They depend on their very own efforts, and that limits how a lot they will develop.

In Wealthy Dad’s Information to Investing, Kiyosaki’s wealthy dad offers some powerful recommendation. He tells Kiyosaki, “You don’t have the experience that employers can pay massive cash for, so that you’ll in all probability by no means make lots as an worker (E).” He additionally says that Kiyosaki isn’t “good” sufficient to be a star within the S quadrant, like a well-known physician, film star, or a sports activities star like Virat Kohli.”

I discovered this a bit harsh, but it surely made sense. Not everybody could be a high skilled or a celeb. So, for many people, the E and S quadrants won’t be the trail to massive wealth.

The Energy of B and I Quadrants

Now let’s take a look at the opposite facet, the B and I quadrants.

That is the place monetary freedom lives. Within the B quadrant, you’re a enterprise proprietor who builds a system. Kiyosaki says, “Enterprise is a crew sport.” A enterprise proprietor doesn’t do all the things themselves, they rent folks, create processes, and let the system run.

For instance, consider a giant model like Britannia. The proprietor doesn’t milk the cows or ship the Cheese, butter, and Biscuits. They’ve a crew for that, and so they earn income from the entire operation.

Once I left my company job in 2017 to give attention to GetMoneyRich.com (now OurWealthInsights.com), I began pondering like a enterprise proprietor. At first, I used to be doing all the things myself, writing, modifying, advertising and marketing. However over time, I understood that, I want a system to work for me.

I’m nonetheless not prepared to rent a crew, however I’ve a system that retains working for me even once I’m asleep. In fact, I’m nonetheless not full off the hooks. Every single day, a set time slot, I’ve to render to my weblog and to my Inventory Engine. If I cease, the work will cease. However since 2017, I’ve constructed a system that may do about 40% of my work, the steadiness 60% remains to be depending on me.

So, ‘am I absolutely within the “B” quadrant? Not but. However for certain, I’ll be there sometime. Additionally, it is not going to be that typical approach of hiring folks, discover an workplace house, paying rents and salaries sort of enterprise. I’ll not try this. I’ve my very own methods of constructing my sources that may work for me 24×7.

For instance, We’ve constructed my Inventory Engine software (in collaboration with my brother). I wrote the monetary algorithm half and he did the appliance half. That is one useful resource (Inventory Engine) I’ve that wants minimal exterior guide intervention. I works nearly by itself.

Shifting towards the B quadrant from S quadrant is just not simple. However the extra I’m progressing, it’s giving me extra time to give attention to larger concepts.

The I quadrant is the final word aim. That is the place your cash works for you. That is what I’ve been working towards by way of my investments. Through the years, I’ve constructed an funding portfolio with a mixture of belongings that retains working for me with out my intervention. I get passive revenue, it is available in whether or not I’m working or not.

Kiyosaki says, passive revenue is the important thing to monetary freedom since you’re now not buying and selling your time for cash.

Why We Concern Shifting to B and I

I do know what you’re pondering, “This sounds nice, however beginning a enterprise is dangerous, and I don’t have cash to take a position!”

I used to suppose the identical approach. Within the ebook, Kiyosaki addresses these fears.

He reminds us that simply 100 years in the past, most individuals have been enterprise house owners. Within the US, 85% of individuals have been farmers or shopkeepers, not workers. Even in India, if you consider our grandparents, lots of them ran small companies or farms. My very own grandfather was an expert trainer in a small college (S Quadrant).

However at this time, we’re taught to be workers. Our training system trains us to get good marks, discover a safe job, and work for another person. Kiyosaki says that is due to the commercial age, which promised job safety and pensions.

However that promise is fading. Through the 2008 monetary disaster, I noticed massive corporations lay off hundreds of workers. Job safety isn’t as safe as we expect, proper?

Beginning a enterprise or investing does really feel dangerous, however staying within the E or S quadrant has its personal dangers. When you lose your job or can’t work, your revenue stops.

Within the B and I quadrants, you’re constructing one thing that may hold incomes even should you step away. It’s like planting a mango tree, it takes effort and time at first, however as soon as it grows, you possibly can benefit from the fruits for years.

How Can We Transfer Ahead?

So, how will we transfer from the left facet of the quadrant (E and S) to the appropriate facet (B and I)?

That is what I’ve been determining over time, and I’ll share what’s working for me and might also assist different.

- First, begin by studying. Learn books like Wealthy Dad Poor Dad or The Clever Investor by Benjamin Graham, they’ll change how you consider cash. I additionally advocate following good monetary blogs to remain up to date.

- Subsequent, take small steps. You don’t need to give up your job tomorrow and begin a enterprise. Once I was nonetheless in my company job, I began running a blog on the facet. It was my approach of testing the S quadrant.

- Over time, I turned my weblog right into a small enterprise. That’s from once I’ve began my transition towards the B quadrant. On the similar time, I began investing small quantities in shares and mutual funds, slowly constructing my presence within the I quadrant.

The secret is to suppose like a crew participant, not a solo participant.

Kiyosaki says, “In the true world of enterprise, daily is take a look at time, and enterprise house owners cooperate at take a look at time.” In class, we’re taught that serving to one another throughout exams is dishonest, however in life, working collectively is the way you succeed.

Discover mentors, be a part of communities, and study from others who’re already within the B and I quadrants.

Conclusion

Money Circulate Quadrant isn’t only a good diagram, it’s a option to perceive the place you’re and the place you wish to go. Once I began my journey, I used to be an worker, buying and selling my time for a wage. At the moment, I’m working towards being a enterprise proprietor and investor, constructing methods and passive revenue that give me freedom. It’s not simple, and it takes time, but it surely’s price it.

Take into consideration your individual life. Are you caught within the E quadrant, all the time buying and selling time for cash? Or are you able to take small steps towards the S, to finally be on the appropriate facet of the Cashflow quadrants? Why proper facet? As a result of that’s the place your cash and methods can be just right for you.

I hope this concept conjures up you as a lot because it impressed me. Let’s continue learning and rising collectively on this journey to monetary freedom.