I usually come throughout some very primary insurance coverage associated queries like

- “I’m not a smoker proper now, if I purchase a time period plan – will I’ve to tell the corporate in case I begin smoking in future”

- “My father simply received recognized with diabetes, Can I get a medical insurance which covers that?”

- “Why my premium have gone up after medicals despite the fact that I’m match and wholesome?”

- “How can an insurance coverage firm pay me Rs 1 crore, when they’re simply charging Rs 15,000 as premium?”

All these questions are very real questions and if somebody doesn’t perceive the rules of Insurance coverage, they may ask them.

So immediately I’m going to share with you the 7 rules on which the insurance coverage trade runs. These are primary rules on which the enterprise of insurance coverage is predicated on. I hope these 7 rules will clear our all of the myths relating to insurance coverage.

Let’s begin

Precept #1 – Precept of Utmost Good Religion (Uberrimae fidei)

The precept of utmost good religion is probably the most primary and first stage precept of insurance coverage and it applies to all form insurance coverage insurance policies. It merely signifies that the one that is getting insured should willingly speak in confidence to the insurer, all his full & true info relating to the subject material of insurance coverage.

The insurer’s legal responsibility exists solely on the idea that no materials truth is hidden or falsely introduced by the individual getting insured.

There’s a course of known as as “Underwriting” in insurance coverage trade which is the exercise of learning the chance and assigning the premium worth for the case and it’s crucial that the individual shopping for any type of insurance coverage tells all of the details accurately and doesn’t disguise it.

If you concentrate on time period plan or medical insurance, it is advisable to accurately point out issues like

- If you’re a smoker or drinker

- Your loved ones sickness historical past

- The Business you’re employed for

- Your Revenue

- Your Age

- Your present diseases (which you might be already conscious of)

If you don’t inform these items accurately, you might be violating the “Precept of utmost good religion” right here and it will possibly influence your insurance coverage declare course of in future.

Precept #2 – Precept of Insurable Curiosity

This precept says that the one that is taking insurance coverage ought to have some insurable curiosity in that factor which is getting insured. So if there shall be monetary loss to the individual if the insured object will get destroyed. If this isn’t the case, insurance coverage can’t be taken

So when a breadwinner takes life insurance coverage for his life, it is sensible as a result of incase the individual dies, there shall be monetary loss to household .

In the identical means, you may get your automotive, bike, residence, gold insured as a result of you may have insurable curiosity in that object. You’ll be able to’t get your neighbor automotive insured and profit since you would not have insurable curiosity in that.

Precept #3 – Precept of Indemnity

Precept of Indemnity says that Insurance coverage is to not make revenue, however solely to compensate you in opposition to the losses incurred. It’s an assurance to revive the identical place which was there earlier than the loss.

So the compensation paid can’t be greater than the losses incurred.

In time period plan, folks ask why corporations ask for revenue particulars. It’s to be sure that an individual takes restricted insurance coverage which matches along with his monetary standing and is sweet sufficient to revive again his household life fashion which was there in existence.

If an individual earns Rs 1 lacs per thirty days. Then Rs 2-3 crores is an efficient sufficient life insurance coverage for the individual they usually can not take Rs 500 crore insurance coverage even when they’ll pay the premiums, as a result of then the intention is to not cowl your monetary loss however to profit/revenue from the insurance coverage coverage.

That’s precisely the explanation why house-wife doesn’t get very excessive insurance coverage, as a result of the motive is to revenue from the dying of non-earning member and never substitute the revenue which that individual was incomes.

Precept #4 – Precept of Contribution

This precept is only a corollary of the precept of indemnity. As per this precept, the insured firm are liable to pay solely their very own contribution they usually have proper to get better again the surplus cash paid from different insurer.

Let’s see the way it works.

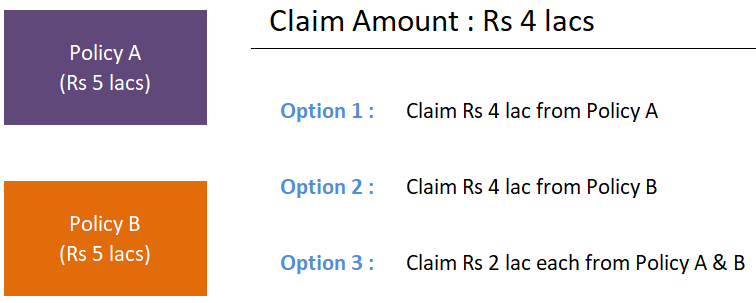

Think about you may have two medical insurance insurance policies A and B , each for Rs 5 lacs sum assured. If there’s a declare for Rs 4 lacs, then every insurer is liable to contribute Rs 2 lacs every for this declare.

Nonetheless in actual life, you as insurer can go to any insurer and declare it from them or divide it between insurers. So you may declare full Rs 4 lacs both from coverage A or coverage B or Rs 2 lacs from A and B every.

Nonetheless in the event you declare Rs 4 lacs from firm A, in that case firm A can get better again Rs 2 lacs from firm B as per the precept of contribution.

Precept #5 – Precept of Subrogation

As per this precept, as soon as the insured is paid for the losses as a consequence of harm to his insured property, then the possession proper of such property shifts to the insurer. So in case your automotive / bike / home / valuables which you may have insured is absolutely broken and when you get compensation from insurance coverage firm, then they get the possession of the merchandise and now they’ll dump the stays to get better their dues by that course of

You’ll be able to’t profit from the stays of that merchandise.

Think about this state of affairs : You may have automotive insurance coverage and the automotive is stolen. The insurance coverage firm pays you the total declare quantity. Nonetheless now the possession rights are transferred to the insurance coverage firm and if the automotive is present in future by Police, it is going to be owned by insurance coverage firm

Additionally, think about a state of affairs the place a automotive is insured and the automotive is badly broken past the use. In that case the insurance coverage firm pays you the declare absolutely. Now you may’t say that you’ll nonetheless dump the automotive elements by getting it repaired since you lose the rights to property.

Another factor ..

As per this precept, the insurer will attempt to get better their losses from different get together later as in the event that they had been at your house. Let me provide you with an instance

Let’s say your own home is insured for Rs 1 crore. Due to some purpose, let’s say your neighbor negligence there was a hearth in your own home and your own home is absolutely broken. On this case you’ll declare from insurance coverage firm, and get the cash.

However after that the corporate will attempt to get better the losses from the perpetrator in the way in which you may need finished it if there was no insurance coverage. So may file a case in opposition to the neighbor’s in court docket claiming for damages.

Precept #6 – Precept of Loss minimization

As per this precept, it’s the insured responsibility & duty to take all actions to reduce the losses if it’s of their management. The insured individual ought to take all mandatory steps to manage and cut back the losses if doable

Think about there’s a small hearth within the automotive for instance. If the automotive is insured, the insured individual can’t simply sit and chill out pondering that the automotive is insured, he’ll get the declare for certain.

If it’s in his management, he can attempt to management the fireplace, name the fireplace division or take first stage steps like throwing water and many others. In the event that they don’t do it, it’s the violation of this precept.

Precept #7 – Precept of Causa Proxima (Nearest Trigger)

It is a crucial precept of insurance coverage which an insured individual needs to be aware of.

As per this precept of causa proxima, when a loss if attributable to a couple of causes, then the closest or the closest trigger needs to be considered to resolve the legal responsibility of the insurer.

The closest trigger needs to be insured by the insurer, solely then the insurer legal responsibility comes into image and coverage holder shall be paid. Insurer won’t be chargeable for the farthest trigger.

One of many frequent examples given for that is this

A cargo ship base was punctured by rats and due to that puncture, sea water entered the ship. Should you have a look at the occasions, there are two causes for harm of ship

- Rats punctured the bottom of ship (farthest)

- Sea Water entered the ship (closest)

Right here because the insurance coverage firm should pay as a result of the ship was insured in opposition to sea water coming into the ship and that purpose was closest.

Conclusion

Understanding these rules are a great way to know how insurance coverage works and the way declare course of works. Simply because you may have taken an insurance coverage coverage doesn’t imply that it’s written in stone that your declare shall be paid. You declare shall be paid solely when insurer legal responsibility arises in a given situation.