I (Nandish Desai) and Manish Chauhan just lately did zoom name for our wealth creation shoppers and from the decision I’m sharing a couple of factors with all of you.

The three phrases previous, current and future have reference to our life, each space of life and in addition our wealth creation journey. All of us have some previous historical past; current second and we’re all strolling in the direction of a future. The inventory market additionally has a previous historical past, current situation and is transferring ahead.

The sharp correction within the inventory market has made many traders suppose whether or not they need to keep invested or give up the market- Kindly undergo all my factors within the article and in addition undergo our zoom name recording to seek out out your individual reply. I’m not right here to ask you to remain invested, I may even not advise you to give up. All I can do is share my experiences, share my ideas which can provide help to to take your individual name.

1. Previous, Current, Future- what area are you in?

All of the workshop or offline occasions we have now performed we see traders working from three totally different spaces- Some are regretting about lacking previous funding alternatives or regretting about beginning their funding journey late, some are shit scared concerning the future (they consistently fear concerning the future) and only a few function from the PRESENT area – The choices and the actions you are taking at this time will form your future.

In reality, NOW is the longer term, if you wish to see your future examine your current actions be it wealth creation or space of well being or every other space of your life.

The present market correction, totally different traders have chosen a unique path. Some have chosen to give up the sport and a few noticed it as a chance to take a position extra, some have proven the braveness to remain within the game- Should you function from a long-term imaginative and prescient, the imaginative and prescient will provide help to to form your current actions. When you have an empowering future in entrance of you, you’ll all the time keep in motion within the current moment- Let an empowering imaginative and prescient drive your monetary journey and never the markets.

2. The most important mistake advisor, Investor and firms have made

Making returns the hero of your monetary life is likely one of the largest errors.

When markets fall solely those that have made returns the hero of their monetary journey suffers and begins to panic- Why not make self-discipline the hero of your monetary journey, who not make consistency the hero of your monetary journey- Wealth creation is a recreation of self-discipline and never about what is occurring within the inventory market.

If I’ve to offer an instance a couple of years in the past individuals use to go to the watch film based mostly on face worth.

If Amitabh Bachchan is within the film individuals go and watch the film, the state of affairs has now modified, individuals search for good content material and the hero of the film isn’t just the actor however a very good story or a very good script- I feel it’s a time to get genuine about selecting the mistaken hero – selecting Self-discipline provides you with full peace of thoughts and you’ll begin to benefit from the general recreation of wealth creation.

Let’s select a brand new hero, let’s select self-discipline.

3. You don’t take into consideration leaving a legacy

Let’s say we’re in 2055 and you might be sitting together with your grandkids – What’s the biggest knowledge you’ll share with them about wealth creation? I’m positive you’ll ask them to remain disciplined, begin early, keep invested, don’t attempt to time the market, don’t panic when markets fall and so on. and so on.

Now, when markets fluctuate you need to remind your self concerning the knowledge you will share within the 12 months 2055 together with your subsequent technology.

Your monetary life is one large story and on the finish your monetary journey has to encourage you and your subsequent generation- Lots of people will need to have stopped their SIP or will need to have give up within the 2020 market fall, the selections you are taking at this time will form your future cash story and so watch out and take actions which lets you go away superb legacy.

Would be the cash you make investments into fairness you aren’t capable of benefit from the fruits however on the finish you should have a fantastic story to inform them. Assume by way of legacy and never simply returns.

4. What you may study from Sachin Tendulkar

Manish offers the next instance within the offline occasions we do, ” He asks individuals what makes Sachin the best batsman within the realm of cricket?”-And we get solutions like, due to his expertise, due to his observe, due to his ardour and so on. from the viewers. Now, he’ll conform to all of the solutions and can add a brand new dimension to the dialog.

He’ll say Sachin has performed 37558 balls in his complete journey of cricket- Together with expertise the true secret is about staying on the pitch and going through the balls- Buyers additionally have to study to remain on the pitch- Every day you keep invested out there must be seen as variety of balls you may have performed – The traders who will face every kind of balls will win the sport of wealth creation.

You develop into Sachin on the planet of funding.

Fund administration, selecting funds, designing portfolios, monetary planning, and advisory are vital however crucial side is staying invested (staying on the pitch) it doesn’t matter what.

5. Heads or Tails

I began my funding journey in 2007, the one who requested me to start out my SIP handed over a coin to me and requested me to get heads each time I toss the coin. I took some probabilities and it was a mixture of heads and tails. I instructed him, “It’s not attainable to get heads each time”.

To that he mentioned, ” Markets and tossing the coin are each the identical, you should have danger and return each within the recreation of funding” I grew to become very clear that there are two sides to the sport of funding and I want to decide on and embrace both- Threat and Return, Most traders solely need returns, it’s like they solely needs heads each time- It’s simply not attainable.

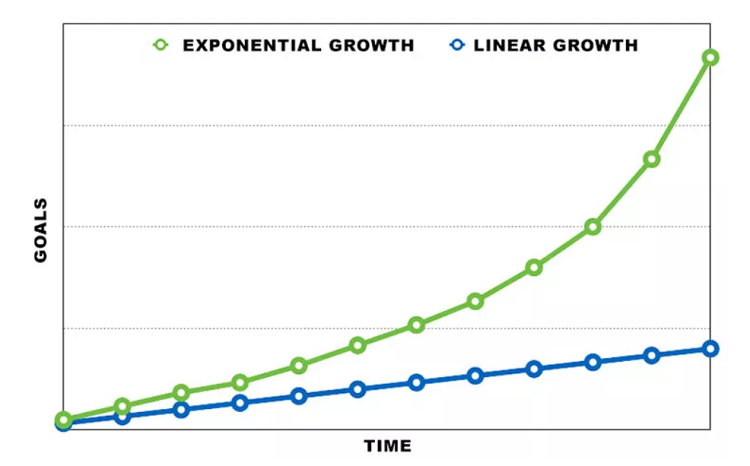

6. Markets are non-linear

The one who helped me begin my SIP additionally instructed me yet another factor. He instructed me – “Nandish markets are non-linear by nature and they’re going to all the time stay non-linear” Mounted Deposit is linear by nature; they aren’t unstable however markets are non-linear and unstable by nature.

All the time keep in mind, you earn money solely in non-linear merchandise that’s the place all of the alternatives reside. Now, when markets fluctuate, I all the time remind myself, ” Markets are non-linear and I acquired to like each ups and downs”

7. The character of the market is development

Market began from 100, then it grew to become 1000 than 10000, 20000 and proper now round 30000. Very quickly it is going to develop into 50000 or 100000, Mark my phrases markets are a sum complete of flats, dips and ups.

The character of the market is enlargement, it’s right here to broaden and develop. it’s as much as you to remain within the recreation or not?- I’ve acquired many emails from shoppers and readers whether or not they need to keep invested out there or not- I simply instructed them,” it’s a alternative you make, it’s your wealth creation story and you’re the author of your cash story”

8. The place the Fairness practice is headed?

One of many instance I like giving is when individuals board a practice which has open seats to occupy, some passengers will selected to take a seat on the left aspect of the practice and a few on the appropriate aspect – Some suppose left aspect will present a greater view and a few suppose proper aspect will present a greater view- However the vital factor isn’t left or proper aspect of the practice, the vital level is the place is the practice headed, that’s the place the passenger has to deal with.

Proper now, some are selecting to take a position and a few are selecting to not make investments however focus must be on the place the fairness practice is headed. As an investor you might be only a passenger, if you’re clear the place the practice is headed you’ll begin to get pleasure from either side of the practice.

9. Be taught to take the ache within the begin

Fairness funding is all the time painful within the start- The primary 3 years are all the time painful, after 7 years it stabilizes a bit and after 10 years issues begin to achieve momentum.

The primary 10 years creates a strong base for one more 10-15 years of your funding journey. With out the primary few years’ ache you received’t be capable of create large wealth. Choose any profitable investor and you can see the ache factor of their wealth creation journey. No ache – No achieve (wealth creation).

A lot of you if you’re new to fairness funding, study to take the ache. Market dips are superb, they construct your immunity to create wealth.

10. Run your race

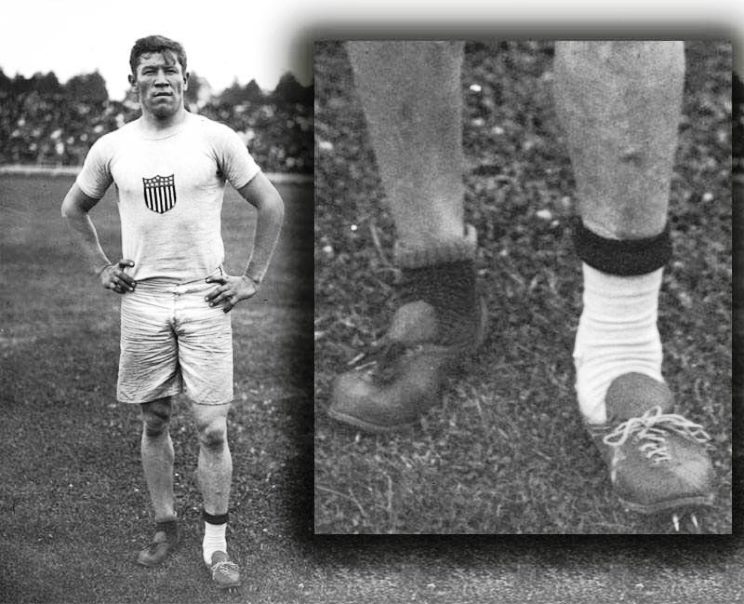

We ended the zoom name remembering Jim Thorpe, the runner, ” His sneakers acquired stolen simply earlier than the race was about to start, he discovered two totally different sneakers from his storage, wore further pairs of socks to slot in the sneakers and received 2 gold medals” – He ran his race and didn’t get stopped by his circumstances. Beneath is his photograph, the place you can see him sporting totally different sneakers and totally different pair of socks, it isn’t a vogue assertion, it reveals his dedication to finish his race, to win the race- It doesn’t matter what

Now, apply his inside stance to your life

- In case your health club is stolen how you’ll train?

- In case your workplace is stolen, how will you do business from home?

- In case your routine is stolen, how will you spend your day?

- In case your returns are stolen, how will you proceed enjoying your recreation of wealth creation?

I train on daily basis, night 7 pm to eight pm – It doesn’t matter what.

My health club has closed (stolen like Thorpe’s sneakers) however I’ve discovered a method to train. My well being has in reality improved by staying at residence, by following a strict food plan. My crew is working laborious from their residence. I’m spending high quality time with my child and in addition doing family work to assist my household.

Come on get in motion, don’t take into consideration what is occurring out there proper now, deal with self-discipline. It’s about your dedication and nothing else.

Conclusion

Undergo all the ten factors as soon as once more and see how they will apply to your monetary life and different areas of your life. Deal with having good well being, deal with staying disciplined, keep away from all of the unfavorable noise outdoors and select to remain on the pitch of wealth creation. When you have by no means skilled monetary planning, we have now the net course prepared for you.

The primary program of Jagoinvestor faculty is been launched and it’s liked by many. Put money into this system and begin planning your funds, select to take a position your time in your individual monetary future.