Sharda Motor Industries Ltd. is steering innovation with strategic ventures in EV battery programs, light-weight options, and technical collaborations. With a rising deal with exports, compliance with evolving emission norms, and sturdy M&A plans, the corporate goals to outpace business development whereas increasing its footprint in home and worldwide markets.

(A) About Sharda Motor Industries Ltd. | Inventory Evaluation

Sharda Motor, integrated in 1986, is the producer of Exhaust System, Catalytic Converter, Impartial Suspension, Seat Frames, Seat Covers (Two Wheelers & 4 Wheelers), Smooth High Canopies, and Pressed part- White items merchandise.

The Firm serves as a ‘Tier I’ vendor for a number of the main Cars and Electronics

Authentic Gear Producers (OEMs). ). It’s got 10 manufacturing services, 3 gross sales places of work, and 1 R&D heart throughout numerous places in 4 states of India.

(B) Business Overview

- It’s projected that the EV market will develop by 36% by FY26, and auto parts exports are anticipated to develop & attain US $80bn by FY26 .

- In Q1 FY25, the passenger automobile section noticed a development of 5% in gross sales quantity in comparison with the identical interval final 12 months, reaching to a complete of 12 lakh items.

- Utility Car skilled a major 20.10% rise, whereas vans section grew by 8.6%.

- Within the Industrial Car section, gross sales grew modestly at 3.8%, reaching to a complete of two.4 lakh items.

- The two-wheeler section noticed vital development with gross sales rising by 19.8%, reaching to a complete of 60 lakhs items.

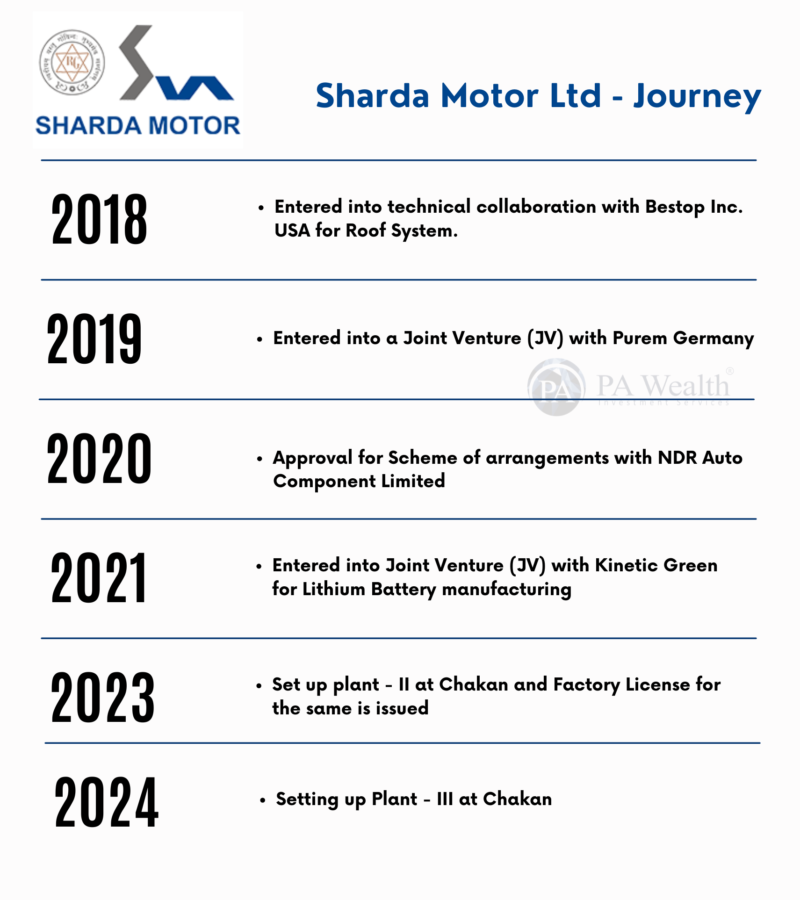

(C) Journey

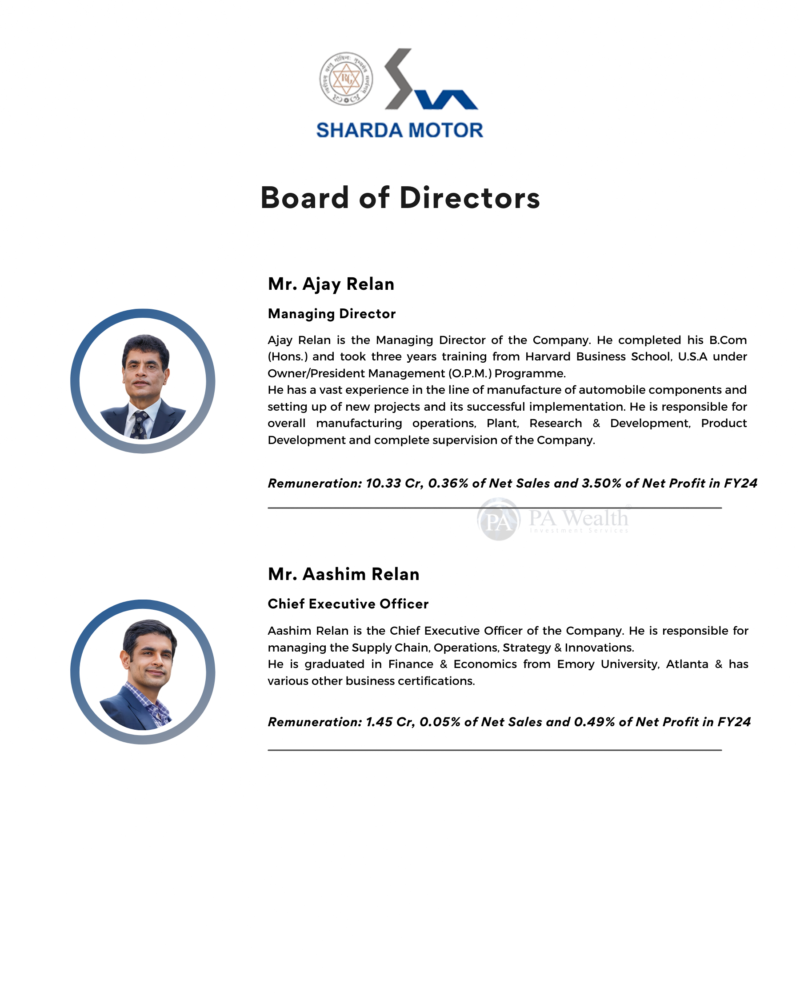

(D) Board of Administrators of Sharda Motor Industries Ltd.

(E) Shareholding Sample of Sharda Motor Industries Ltd.

(F) Product Segments of Sharda Motor Industries Ltd. | Inventory Evaluation

(i) Exhaust Programs

This section serves PV, CV and Off-road section and catering to a lot of the OEM’s in PV section. The corporate has an Indian Market Share of ~30% for passenger automobile section. With an annual manufacturing of ~1 million items, the corporate is catering to each, Home & Worldwide clients.

SMIL caters to main tractor producers like Escorts, TAFE, Kubota, and many others., and CV gamers like Tata Motors, Ashok Leyland, Drive Motors, and many others.

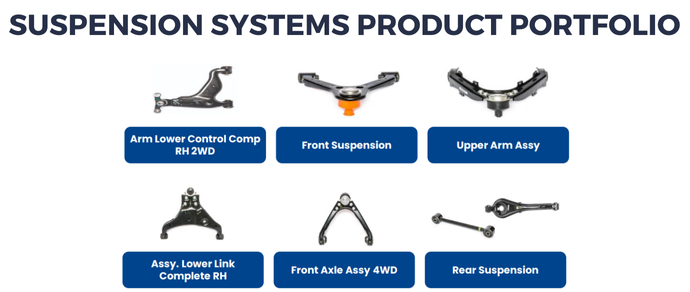

(ii) Suspension Programs

SMIL manufactures suspension programs for the Passenger Automobiles, Industrial Automobiles, and the Off-road segments. The suspension section has a market share of ~10% in management arms for passenger automobile section with two manufacturing items at Nashik and Pune. The corporate has an annual manufacturing of ~1.8 lakh items.

(iii) Rooftops

It is a area of interest class and SMIL entered this market with a technical collaboration with Bestop Inc. SMIL does convertible cover and gentle high cover on this section. That is solely a minor contributor to SMIL’s revenues.

(G) Income Segments of Sharda Motor Industries Ltd.

(H) Value Construction of Sharda Motor Industries Ltd.

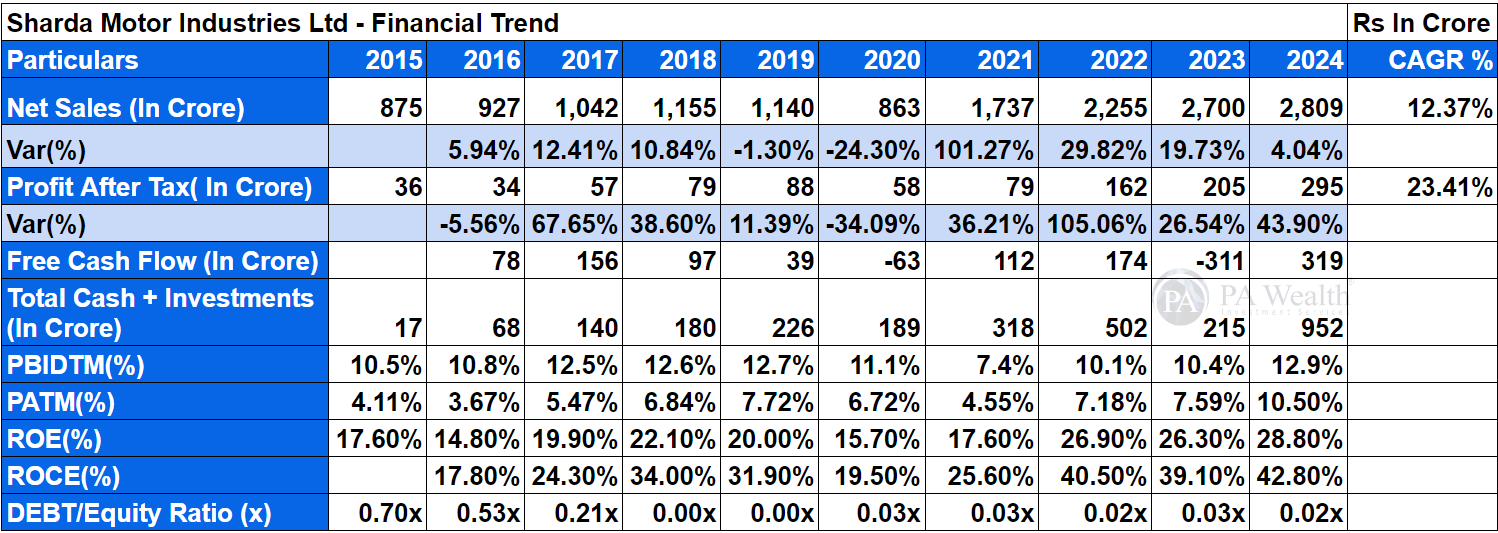

(I) Financials of Sharda Motor Industries Ltd.

The corporate’s income has grown at a CAGR of 12.37% over the previous 10 years, rising from Rs 875 Cr in FY15 to Rs 2,809 Cr in FY24. Subsequently, the corporate’s PAT has additionally proven development, rising from Rs 36 Cr in FY15 to Rs 295 Cr. in FY24 at a CAGR of 23.41%.

(J) Administration Dialogue & Concall | Inventory Evaluation

- The corporate’s foray into EV house by way of a JV with Kinetic Inexperienced for growing Battery Packs with Battery Administration Programs (BMS) has reached the testing section and the corporate expects to start industrial manufacturing within the coming quarters.

- They’re planning to accomplice with the OEMs already in gross sales of EVs, assuring prepared market and expertise.

- Sharda Motors has entered a technical collaboration with Bestop Inc., USA for the manufacturing of roof programs.

- SMIL and Purem (previously referred to as Eberspaecher) has entered a JV to fabricate industrial automobile exhaust programs in India.

Outlook

- TREM V norms for building tools autos and all tractors are scheduled to be carried out from April 1, 2026. With the applicability of recent emission norms, the Off Freeway addressable marketplace for the corporate will develop into equal or bigger than the present Industrial Car market.

- Within the PV section BS-VI RDE norms have been carried out from April, 2023 requiring vehicles to realize emission targets even in actual world situations, versus only a laboratory setting. The applicability of RDE norms would improve the content material per automobile by 10-15% for SMIL.

- Firm is targeted on the US and European markets for exports. Exports at present contribute lower than 5% of gross sales, however administration expects substantial development on this space over the following 3-5 years.

- Over the interval of 5 years, SMIL is planning to outperform the business.

Q2 FY25 Concall Highlights

- Sharda has purchased again 10,27,777 fairness shares at Rs.1,800 per share, totaling to Rs.185 crores.

- The administration’s first desire for money reserves is M&A targeted on powertrain agnostic merchandise.

- Estimated EV Penetration by 2028 in CV will probably be 1-8% & in Farm Gear it is going to be 0-1%.

- In lightweighting vertical, a brand new plant could be developing by Q3 FY25, specializing in lightweighting and suspension programs. Roughly ₹50 crores funding will probably be made on the plant.

- TREM V market (tractors) and off-highway exports, which at present contribute underneath 5% of gross sales however are anticipated to develop considerably.

- 2-wheeler and 3-wheeler segments confirmed sturdy efficiency, whereas passenger and industrial automobile segments confronted declines.

- The corporate is targeted on increasing its export enterprise and growing new buyer relationships, notably within the building tools market.

- The corporate has a robust buyer curiosity in new product launches within the suspension enterprise, with a brand new plant anticipated to start operations in This fall FY ’25.

(Okay) Strengths & Weaknesses

Strengths

1. Established market place and powerful buyer base:

Expertise of round three a long time in manufacturing exhaust programs has enabled the promoters to develop heathy relationships with OEMs corresponding to Mahindra and Mahindra Ltd, for which SMIL is the popular provider of unbiased entrance suspension programs. It additionally caters to varied fashions of Hyundai Motor India Ltd and Tata Motors Ltd. Other than exhaust programs, SMIL manufactures and provides numerous suspension programs and trades in catalytic convertors for its clients.

2. Debt free firm with sturdy money era:

SMIL is a debt-free firm with low capital expenditure necessities. It will possibly meet rising buyer calls for with minimal incremental capex, which it plans to fund by way of its sturdy working money movement. Administration goals to make use of the generated money for inorganic alternatives in powertrain-agnostic merchandise or to return it to shareholders by way of larger dividend payouts.

Weaknesses

1. Buyer focus

The highest 3 clients account for ~75-80% of income. Lack of any of those clients may have a considerable impression on the corporate’s financials.

2. Susceptibility to extend in uncooked materials costs and pricing strain from OEMs:

The corporate has restricted bargaining energy with OEMs, which periodically revise costs based mostly on their monetary standing and willingness. As such, any profit in working margin comes with a lag. SMIL has sturdy market place and area of interest product profile which permits it to cross on worth will increase, though with a lag, supported by wholesome and sustained EBITDA margin.

Drop us your question at – data@pawealth.in or Go to pawealth.in

References: Annual Experiences, Information Publications, Investor Shows, Company Bulletins, Administration Discussions, Analyst Meets and Administration Interviews, Business Publications.

Disclaimer: The report solely represents the non-public opinions and views of the writer. No a part of the report needs to be thought of a advice for purchasing/promoting any inventory. Thus, the report & references talked about are just for the knowledge of the readers concerning the business acknowledged.

Most profitable inventory advisors in India | Ludhiana Inventory Market Ideas | Inventory Market Specialists in Ludhiana | High inventory advisors in India | Finest Inventory Advisors in Gurugram | Funding Consultants in Ludhiana | High Inventory Brokers in Gurugram | Finest inventory advisors in India | Ludhiana Inventory Advisors SEBI | Inventory Consultants in Ludhiana | AMFI registered distributor | Amfi registered mutual fund | Be a mutual fund distributor | High inventory advisors in India | High inventory advisory providers in India | Finest Inventory Advisors in Bangalore