ASK Automotive Ltd – Driving security by way of innovation

Based in 1988, ASK Automotive Ltd. is a number one auto-ancillary firm in India, specializing in superior braking programs (ABS) for 2-wheelers and precision aluminium lightweighting options. A market chief in 2-wheeler ABS, together with brake footwear and disc brake pads, ASK serves OEMs, OES, and IAM segments. With 17 manufacturing services throughout India, it exports to over 12 international locations and employs 7,000+ individuals. The corporate companions with prime manufacturers like Honda, Hero MotoCorp, Suzuki, TVS, Yamaha, Bajaj, Royal Enfield, Ola, and Ather.

Merchandise and Providers

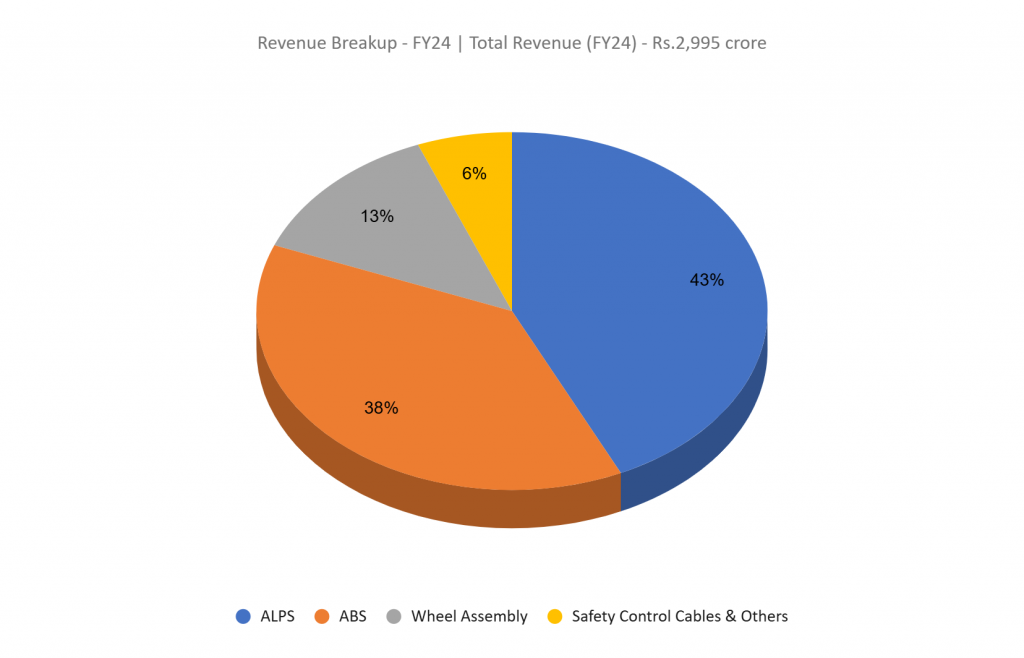

ASK Automotive Ltd. presents merchandise throughout three key segments:

- Superior Braking Programs (ABS):

Brake footwear, brake pads, brake panel assemblies, clutch plates, clutch footwear, brake linings, disc brake pads, and brake liners. - Aluminium Light-weight Precision Options (ALPS):

Crank circumstances, engine covers, pillion grips, ECU our bodies, throttle our bodies, and electrical motor housings. - Security Management Cables:

Entrance brake cables, rear brake cable assemblies, throttle cables, speedometer cable assemblies, and equipment shift cables.

Subsidiaries: As of FY24, the corporate has 1 subsidiary and 1 three way partnership.

Development Methods

- Market Management: Dominates India’s 2-wheeler ABS market with a ~50% share and can also be a prime producer of ALPS and security management cables, serving main OEMs with powertrain-agnostic merchandise, together with EV options.

- Growth Plans: Organising an 18th manufacturing plant in Bengaluru at an estimated value of ₹200 crore, anticipated to be operational by Q4FY25 to cater to South India’s OEMs.

- Export Development: Secured ₹75 crore in export orders throughout Q2FY25 and is targeted on increasing its international footprint regardless of short-term disruptions in US operations.

- Renewable Vitality Focus: Growing a 9.9 MWp mega solar energy plant in Sirsa, Haryana, for in-house consumption, reinforcing its dedication to sustainability.

- EV Sector Push: Advancing light-weight aluminium merchandise for EVs with a robust pipeline of progressive options tailor-made for EV OEMs.

- Diversification: Getting into area of interest markets like 2-wheeler high-pressure die-cast (HPDC) alloy wheels to increase product choices and market attain.

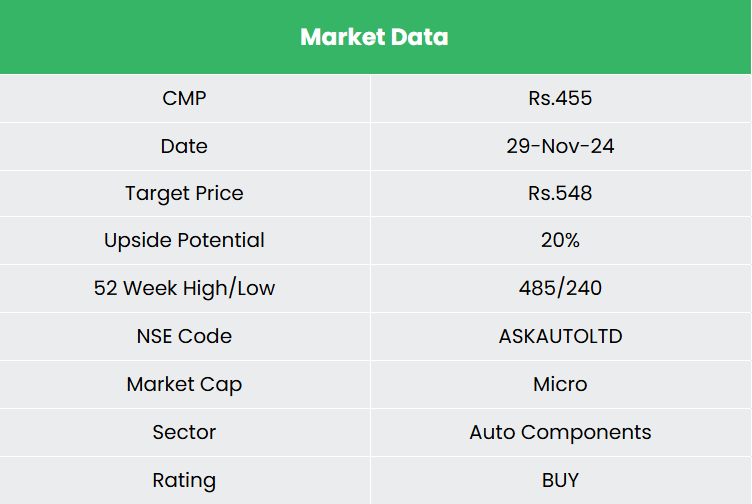

Monetary Efficiency

Q2FY25

- Income Development: Recorded ₹976 crore in income, a 22% YoY improve from ₹798 crore in Q2FY24.

- Phase Efficiency:

Superior Braking Programs (ABS): Achieved 18% YoY progress, sustaining market management.

ALPS: Witnessed 27% YoY progress.

Security Management Cables: Improved by 18% YoY.

- EBITDA Development: Elevated by 51% YoY to ₹119 crore from ₹79 crore, with EBITDA margin rising from 10% to 12%.

- Web Revenue: Surged by 63% YoY to ₹67 crore in comparison with ₹41 crore in Q2FY24.

FY24

- Income Development: Achieved ₹2,995 crore in income, marking a 17% YoY improve over FY23.

- Working Revenue: Recorded ₹311 crore, reflecting a 25% YoY progress.

- Web Revenue: Posted ₹174 crore, a big 41% YoY improve.

- Growth: Efficiently commenced operations at a brand new manufacturing plant in Karoli, Rajasthan.

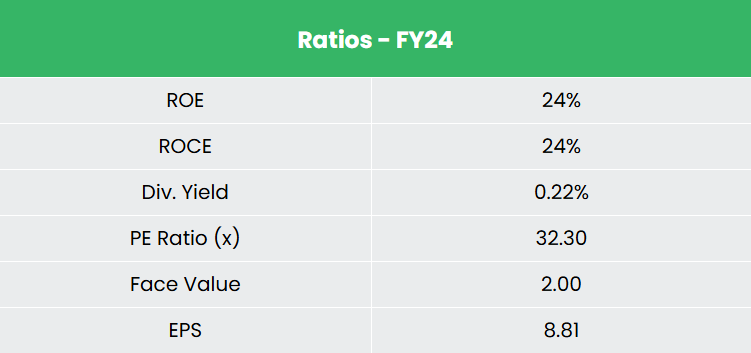

Monetary Efficiency (FY21-24)

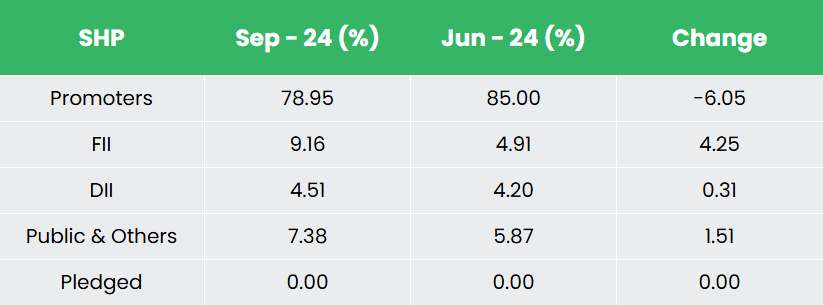

- Income & PAT Development: The corporate has achieved a income and PAT CAGR of 25% and 23%, respectively, over the 3-year interval from FY21-24.

- Robust Return Ratios: Common ROE and ROCE stand at 19% and 20%, respectively, for the FY21-24 interval.

- Capital Construction: The corporate maintains a robust capital construction with a debt-to-equity ratio of 0.43.

Business outlook

- Rising Demand: India’s auto parts business has grown considerably, pushed by rising incomes, infrastructure investments, and manufacturing incentives.

- Two-Wheeler Phase Dominance: The 2-wheeler market, propelled by a rising center class, led the business with 23.85 million items offered in FY24.

- OEM Development: The surge in vehicle demand has fueled the expansion of authentic tools producers (OEMs) and auto part producers.

- International Enchantment: India’s automotive manufacturing experience has boosted worldwide demand for its automobiles and parts.

- Localization Increase: The rising presence of worldwide OEMs in India has accelerated the localization of their parts.

Development Drivers

- Demographic Benefit: Growth of the working inhabitants and a rising center class are fueling demand.

- FDI Assist: 100% FDI beneath the automated route boosts investments within the auto parts sector.

- Future Potential: The Indian auto parts business is projected to succeed in US$ 200 billion by FY26, highlighting sturdy progress alternatives.

Aggressive Benefit

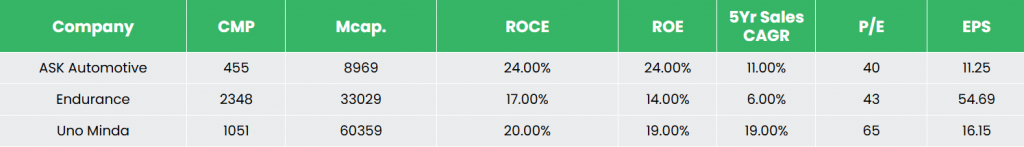

ASK Automotive stands out amongst rivals like Endurance Applied sciences Ltd. and Uno Minda Ltd., showcasing regular income progress, superior return ratios, and sturdy earnings potential. Its monetary stability and environment friendly capital utilization underline its skill to ship constant revenue and returns, setting it aside within the auto parts business.

Outlook

- Karoli Plant Ramp-Up: Manufacturing on the new facility has achieved constructive EBITDA margins, with full capability utilization anticipated in 1-2 years.

- Funding Plans: CAPEX steerage set at ₹250-300 crore for FY25, alongside a focused 25% ROE.

- Development Drivers: Growth supported by economies of scale, new orders, consumer acquisitions, elevated manufacturing at new services, and price optimization efforts.

- Sustainability Dedication: The nearing completion of a photo voltaic plant aligns with sustainability targets, providing a 5-year payback interval.

- Debt Discount: Actively engaged on reducing the debt ratio to strengthen the capital construction.

- Recognition: A current ranking improve from CRISIL underscores the corporate’s sturdy enterprise mannequin and progress potential.

Valuation

ASK Automotive’s market management, strategic deal with the EV sector, export growth, and product diversification place it for sustained progress. These elements drive our constructive outlook, resulting in a BUY suggestion with a goal worth (TP) of ₹548, representing 47x FY26E EPS.

Dangers

- Business Threat: Roughly 80% of the corporate’s income comes from India’s 2-wheeler automotive sector. Any antagonistic modifications on this business might negatively have an effect on the corporate’s operations and monetary well being.

- Uncooked Materials Value Volatility: Disruptions within the provide or fluctuations within the costs of key supplies, significantly aluminium, might put strain on the corporate’s margins.

Observe: Please notice that this isn’t a suggestion and is meant just for academic functions. So, kindly seek the advice of your monetary advisor earlier than investing.

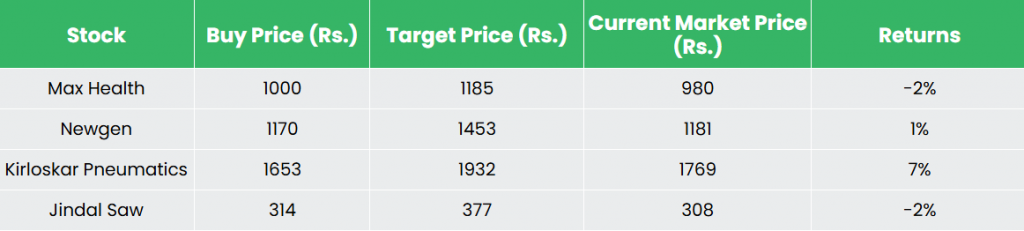

Recap of our earlier suggestions (As on 29 November 2024)

Max Healthcare Institute Ltd

Newgen Software program Applied sciences Ltd

Kirloskar Pneumatic Firm Ltd

Jindal Noticed Ltd

Different articles chances are you’ll like

Submit Views:

180