Have you ever dreamed of your individual home? Are you planning to purchase your first home?

However, shopping for personal home is just not doable with out taking loans and paying heavy EMI’s. Nonetheless, now it’s fairly doable for brand spanking new residence consumers with sponsored mortgage given beneath “Pradhan Mantri Awas Yojana” which is an initiative by authorities beneath “Reasonably priced Housing for all by 2022” within the nation. It is usually referred as credit score linked subsidy.

With this scheme you should purchase a brand new residence/flat, assemble a home or you may improve your private home by including room, bathroom or kitchen. Until date 15 Lakhs home has been constructed and 75 Lakhs loans has been sectioned beneath this scheme. The general construction of the scheme is just not simple to grasp. So, let’s perceive all the weather in easy factors.

1. Who can go for PMAY?

- A First time residence purchaser, who doesn’t have any residence on his identify or in identify of any member of the family.

- He or his household shouldn’t have availed any central help beneath any housing scheme of presidency.

- A person who has a pucca home and desires to reinforce it by including bathroom, room or kitchen and so on.

Household contains Self, Partner and Kids. However, if daughter/son is incomes adults(no matter marital standing), than he/she might be handled as a separate entity. So, this implies even when mother and father and incomes kids are staying in a home owned by mother and father, they’ll individually go for PMAY supplied he/she doesn’t have nay home personal identify.

2. What would be the eligibility and subsidy?

Authorities has categorized totally different teams taking their annual incomes in to consideration, which might be useful in evaluating eligibility and quantity of subsidy. Following desk reveals totally different teams and different standards.

[su_table responsive=”yes” alternate=”no”]

| Teams | Annual Revenue | Most mortgage quantity for subsidy | Rate of interest for subsidy | Most Subsidy Quantity | Allowed Space |

| Economically Weaker Part (EWS) | Upto Rs. 3 Lakhs | Upto Rs. 6 Lakhs | 6.50% | Rs. 2.60 Lakhs | 30 sq. mt. (322.917 sq. ft.) |

| Low Revenue Group (LIG) | Rs. 3-6 Lakhs | Upto Rs. 6 Lakhs | 6.50% | Rs. 2.60 Lakhs | 60 sq. mt. (645.834 sq. ft.) |

| Center Revenue Group-1 (MIG 1) | Rs. 6-12 Lakhs | Upto Rs. 9 Lakhs | 4% | Rs. 2.35 Lakhs | 160 sq. mt. (1722 sq. ft.) |

| Center Revenue Group-2 (MIG 2) | Rs. 12-18 Lakhs | Upto Rs. 12 Lakhs | 3% | Rs. 2.30 Lakhs | 200 sq. mt. (2152.78 sq. ft.) |

[/su_table]

*1 sq mt = 10.7639 sq ft

*Most time period allowed for subsidy is 20 years for all of the 4 teams. Meaning subsidy might be calculated for the time period of mortgage or 20 years whichever is much less.

*Curiosity portion of EMI at sponsored charge might be discounted at 9% to get the web current worth of subsidy.

Let’s perceive the above desk by way of case studies-

1. In case your annual incomes is Rs. 3,00,000 and you’ve got taken residence mortgage of Rs. 10 Lakhs for 15 years at 8.50% curiosity p.a. So, what would be the subsidy quantity?

As your incomes is Rs. 3 Lakhs, you fall in EWS group. So, You’re going to get 6.5% of curiosity subsidy on Rs. 6 Lakhs of mortgage for time period of 15 years supplied the home space is just not exceeding restrict of carpet space of 30 sq. mt. The quantity of subsidy might be Rs. 2.09 Lakhs (Again calculation – contemplating EMI at 6.5% on mortgage quantity of Rs. 6 Lakhs for 15 years and curiosity portion out of it discounted at 9% to get NPV).

2. In case your annual incomes is Rs.8,00,000 and you’ve got taken residence mortgage of Rs. 20 Lakhs for 25 years at 8.50% curiosity p.a. So, what would be the subsidy quantity?

As your incomes is Rs. 8 Lakhs, you fall in EWS group. So, You’re going to get 4% of curiosity subsidy on Rs.9 Lakhs of mortgage for time period of 20 years and never 25 years (as most time period is 20 years) supplied the home space is just not exceeding restrict of carpet space of 160 sq. mt. The quantity of subsidy might be Rs. 2.35 Lakhs (Again calculation – contemplating EMI at 4% on mortgage quantity of Rs. 9 Lakhs for 20 years and curiosity portion out of it discounted at 9% to get NPV).

You may refer the video given under to grasp PMAY –

3. Will subsidy be given for present residence mortgage?

The subsidy beneath this scheme will be availed on present residence loans sanctioned on or after 17/06/2015 for EWC part and LIG part. And for MIG 1 & MIG 2 subsidy will be availed if mortgage is part on or after 01/01/2017.

So, if in case you have an on going residence mortgage which you acquired in 2017. In that case additionally you may apply beneath PMAY to avail subsidy. And the quantity of subsidy might be calculated as per your present earnings incomes part i.e. if now you might be incomes 10 Lakhs then you’ll fall beneath MIG 1 and unique time period of mortgage might be taken in to consideration.

4. Find out how to enroll to avail advantages beneath this scheme ?

You may enroll for this scheme on-line or offline. In offline mode you might want to go to the financial institution from the place you need to apply mortgage or the place your private home mortgage is present, get the type of PMAY and fill & submit the identical.

For the net mode you might want to comply with following steps –

Step 1#: Go to the web site of PMAY. Beneath given web page will seem –

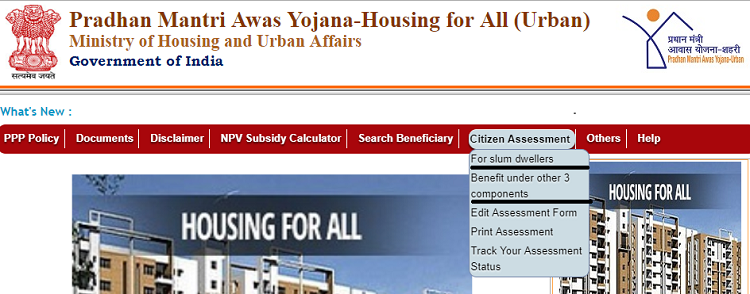

Step 2#: Click on the citizen evaluation drop-down and choose the advantages beneath three elements as proven under.

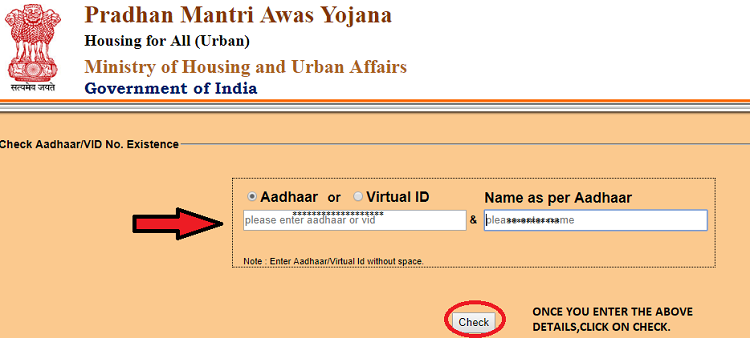

Step 3#: When you click on the profit beneath different 3 elements, the under window seems. Now enter your Aadhaar particulars and or digital ID and click on on test.

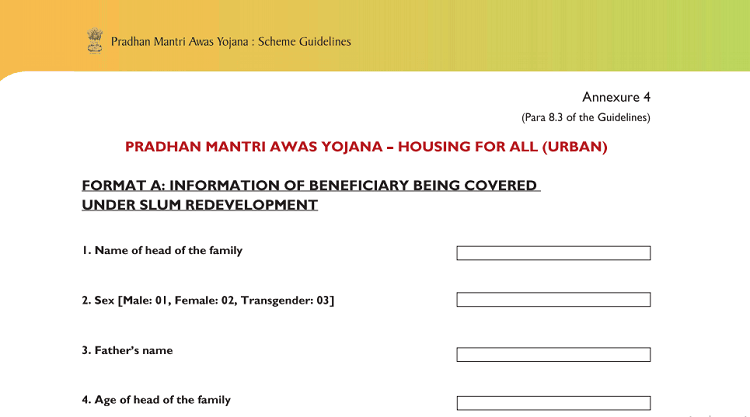

Step 4#: When you test your Aadhaar card existence, the under web page will seem. Fill the shape with required particulars. To present you a glimpse, screenshot is connected.

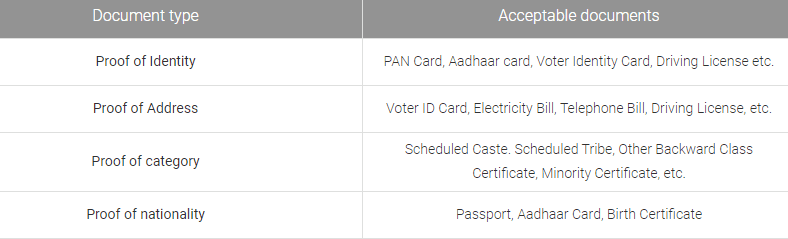

Step 5# Connect required paperwork

As soon as your software is submitted, after due examination in case you are a eligible beneficiary beneath PMAY, you may be added to the checklist of beneficiary. You could find it on the web site of PMAY in beneficiary tab. In case your identify is available in beneficiary checklist then you might want to inform about the identical to the financial institution from the place you may have granted mortgage.

5. How will I obtain the curiosity subsidy profit beneath PMAY Scheme?

The Financial institution (the place you may have utilized for a mortgage beneath this scheme) will declare subsidy profit for eligible debtors from Nationwide Housing Financial institution (NHB). The NHB will conduct due diligence to exclude claims the place the shopper has submitted a number of requests. Then all of the eligible debtors will obtain the subsidy quantity to the Financial institution.

As soon as the Financial institution receives the curiosity subsidy, it is going to be credited upfront to the mortgage account. Subsequently it’s known as credit score linked subsidy. For instance, If the you avails a mortgage for Rs. 8 lakh and the subsidy acquired is Rs. 2, 20,000. The subsidy quantity (Rs. 2, 20,000) could be diminished upfront from the mortgage quantity (i.e., the mortgage would scale back to Rs. 5, 80,000) and then you definitely would pay EMIs on the diminished quantity of Rs. 5, 80,000.

And in addition in case your EMI is on going and you might be eligible for subsidy. Then it’s possible you’ll be supplied by your financial institution for utilizing subsidy as credit score so your EMI might be diminished or for decreasing the time period of mortgage. I’d counsel to go along with decreasing time period of mortgage.

FAQ OF PMAY SCHEME:

Is lady co-ownership is obligatory for availing subsidy?

Sure, for EWS and LIG class of subsidy lady co-ownership is obligatory whether or not or not it’s the case of recent home or addition of kitchen/bathrooms and so on. And for MIG 1 & MIG 2 it isn’t obligatory to have a lady co-owner to the home property.

Can I do renovation/up-gradation in an present home with the assistance of this scheme?

Sure, you may if you happen to fall beneath MIG 1 or MIG 2 part. You cannot avail subsidy for renovation if you happen to fall beneath EWS or LIG.

Is it obligatory to fetch Adhaar card particulars for all of the members of the beneficiary household?

Sure, for processing the subsidy beneath PMAY for MIG 1 and MIG 2, it’s obligatory to furnish the Aadhaar card particulars of all of the members of the family.

I hope this text has helped you in understanding that how one can avail advantages beneath PMAY Scheme. Please be at liberty to ask your doubts or queries the in remark part.