Be a part of Our Telegram channel to remain updated on breaking information protection

Jim Chanos has confirmed that his funding agency Kynikos Associates has unwound its brief place on Michael Saylor’s Technique, a transfer one analyst mentioned may sign the top of the bear marketplace for Bitcoin treasury companies.

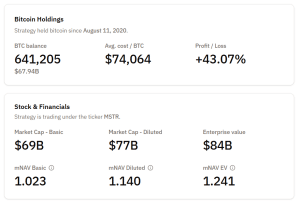

Chanos, a veteran funding supervisor who’s finest identified for shorting Enron earlier than its collapse in 2001, mentioned the transfer got here after Technique’s share value plunged 50% from its peak, and with its market Web Asset Worth (mNAV) now compressed to 1.23x.

As we have now gotten some inquiries, I can affirm that we have now unwound our $MSTR/Bitcoin hedged commerce as of yesterday’s open. pic.twitter.com/lgrWNy35H8

— James Chanos (@RealJimChanos) November 8, 2025

Technique Premium Anticipated To Compress Even Extra

MSTR’s implied premium, which is its enterprise worth minus the worth of its 641,205 BTC reserves, has dropped from round $70 billion in July to $15 billion now.

In a screenshot of a notice despatched to buyers that was shared on X, Chanos mentioned his agency expects Technique’s premium to compress much more because the Bitcoin treasury firm “continues to challenge widespread fairness.”

However he really helpful “letting others chase the final leg of the commerce as MSTR inevitably marches in the direction of a 1.0x mNAV.”

Analyst Says Bitcoin Treasury Bear Market Is Nearing Finish

Responding to Chanos’s put up, The Bitcoin Bond Firm CEO Pierre Rochard mentioned “the Bitcoin treasury firm bear market is regularly coming to an finish.”

”Anticipate continued volatility however that is the type of sign you wish to see for a reversal,” he added.

I doubt that is an indication the bear market is over. That was a variety commerce. The lack of the Technique premium is a bearish sign. It seemingly signifies a reduction is subsequent.

— Peter Schiff (@PeterSchiff) November 9, 2025

However Bitcoin permabear Peter Schiff took challenge with Rochard’s put up, saying he doubt it indicators the top of a bear market.

The corporate’s declining premium “is a bearish sign,” he mentioned, including that it “seemingly signifies a reduction is subsequent.”

Rochard quickly fired again.

“With all due respect Mr. Schiff, given your monitor report of being bearish on Bitcoin since 2011, please forgive us if we put you within the counter-signal bucket with Mr. Cramer,” he mentioned.

Saylor Hints At One other Technique Purchase Regardless of MSTR Downtrend

Technique began shopping for Bitcoin again in 2020 as a part of a company treasury plan and is now the biggest digital asset treasury (DAT) agency globally, with Bitcoin Treasuries exhibiting its BTC holdings are valued at greater than $67 billion.

Technique BTC holdings (Supply: Bitcoin Treasuries)

The corporate is sitting on an unrealized revenue of over 43%.

Technique Doubles Down On Bitcoin

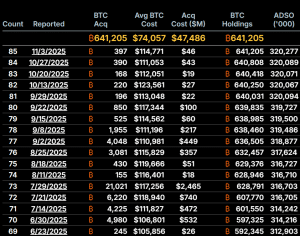

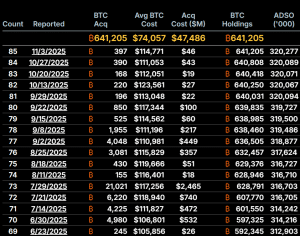

Despites its plummeting share value, Technique has continued to develop its Bitcoin reserves in current weeks, albeit at a slower tempo than earlier within the 12 months.

Current Technique BTC buys (Supply: Technique)

In a put up on X yesterday, Technique’s founder Michael Saylor posted a screenshot of the SaylorTracker chart with the caption “₿est Proceed.” Similar posts by Saylor have invariably been adopted by bulletins of a brand new BTC purchase.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection